Crude oil has gotten great deal of attention of late with the bombing of a major oil field in Saudi Arabia – and the resultant volatility in the price of crude. Forgetting all of the hubbub for the moment, history suggests that there is a time to NOT hold long crude oil.

The time to be wary of a long position in crude oil is when the two following factors are in place:

- The current month is October, November, December or January

- The price of crude oil is below its 4-month moving average*

*- For the record, this uses monthly closing prices and is updated only at the end of each month. Another alternative is to use monthly closing prices for ticker DBO – the Invesco DB Oil Fund

Figure 1 displays a monthly chart of spot crude oil along with its 4-month moving average

Figure 1 – Spot crude oil futures with 4-month moving average (Courtesy ProfitSource by HUBB)

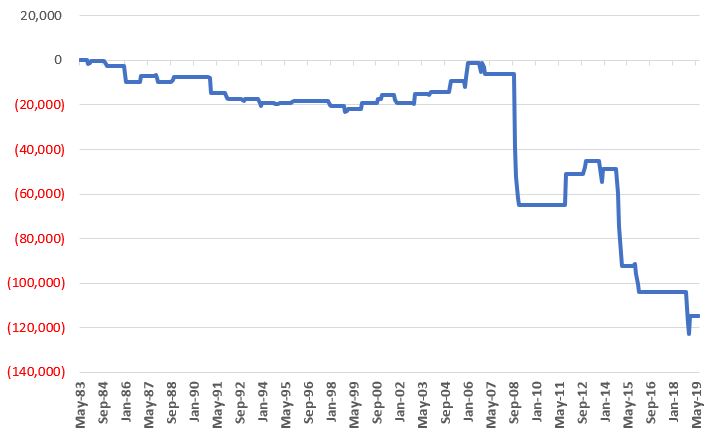

Figure 2 displays the, ahem, “growth” of equity if a trader held a long position in crude oil futures ONLY when the two factors listed above are both in force.

Figure 2 – Long 1-lot of crude oil when “When NOT to hold crude oil” factors are both active

One thing to note is that crude oil actually did increase in value roughly 40% of the time when the 2 negative factors were both active. However, clearly some bad things have happened when these factors were flashing red.

According to this “method”, if crude oil (or ticker DBO) closes September (or October, November and December) below it’s 4-month average, traders might be wise to “fight the urge” to play the long side of crude oil.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.