Let’s face it, some things are harder to explain than other. Take for instance seasonality in the bond market. If I were to tell you that some days were consistently better than others for treasury bonds chances are you might say “that doesn’t make any sense.” And you would have a point. But then again, so would I. To wit…

Good Days, Bad Days

Good Days for treasury bonds include: Trading days of the month #10, #11 and #12 and the last 5 trading days of the month

Bad Days for treasury bonds include: All other days of the month not listed above

Can it really be that simple? See Figures 1 and 2 below ad decide for yourself.

The Data

For testing purposes, I use the daily price change in the active month for the U.S. 30-year treasury bond futures contract times $1,000 (each point movement for a t-bond futures contract is worth $1,000).

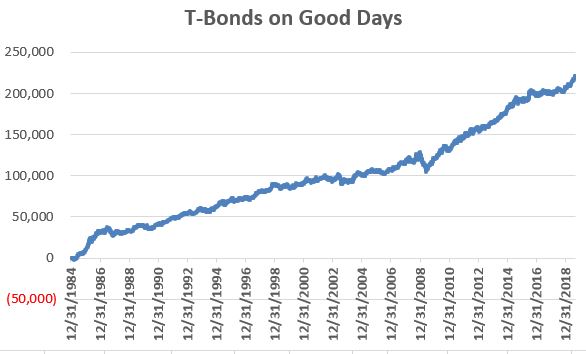

Figure 1 displays the cumulative growth of holding a long position only on the Good Days listed above starting on 12/31/1984.

Figure 1 – Cumulative growth of a long position in t-bond futures ONLY during Good Days (Dec-1984-present)

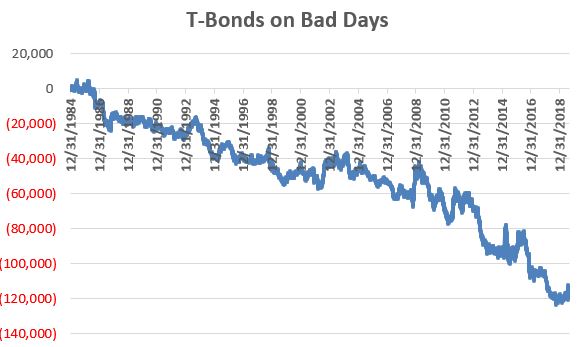

Figure 2 displays the cumulative growth of holding a long position only on the Bad Days listed above starting on 12/31/1984.

Figure 2 – Cumulative growth of a long position in t-bond futures ONLY during Bad Days (Dec-1984-present)

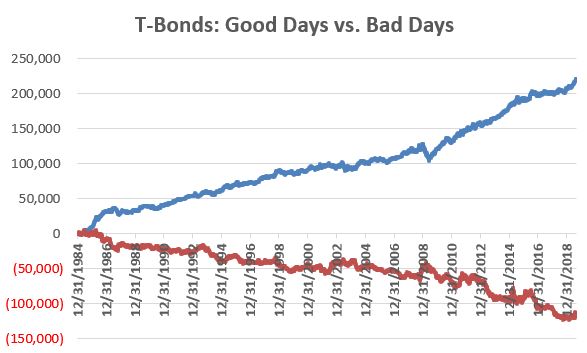

In case nothing jumps out at you, Figure 3 displays the two equity curves from Figures 1 and 2 on the same chart.

Figure 3 – T-Bonds on Good Days (blue line) versus T-Bonds on Bad Days (red line) (Dec-1984-present)

Interesting, no?

Useful? That’s up to each trader to decide for themselves.

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.

Fascinating. Any thoughts on what causes these performances for the 30 yr? It would be great to see these dates/years to compare.

The 10th “normal” trading day of October, 2019 is the 14th.

But, that is Columbus day, and the bond market is closed.

What is the 10th trading day for this system? The 14th or 15th?

Donald, Only count actual trading days. Jay

So, for this system, the 10th trading day of October, 2019 is the 15th?

Yes