As I mention often, the purpose of this blog is not for me to offer “recommendations” or to offer investment advice. The purpose is solely for me to point out “things” that I have observed in the past that have tended to work, as well as the occasional “current events” commentary (also, because I suck at golf, I needed a different hobby, but I digress).

Like most people I try to stay “topical” and comment on things that the majority of investors/traders will find relevant. But the nature of investing means sometimes there can be an advantage to going “off the beaten path.” So rather than talking about “which way the Dow”, or “will the dollar stay strong”, or “trade wars”, or everybody’s favorite topic, the inverted yield curve, we are going way “off road” and look at some ideas that are so contrarian even contrarians can’t stand to talk about them.

Welcome to the exciting world of commodities! Now before you click the back arrow and move onto the next article, note that most of these ideas can now be traded using ETFs rather than futures contracts (which offer the greatest profit potential but which should also be avoided by most investors due to the leverage).

So, let’s look at some commodities that:

*Are entering a favorable “seasonal” period

*Have a very low level of favorable trader sentiment (typically considered bullish form a contrarian point of view)

To illustrate these “opportunities(?)” we will rely on charts from www.SentimentTrader.com

Coffee

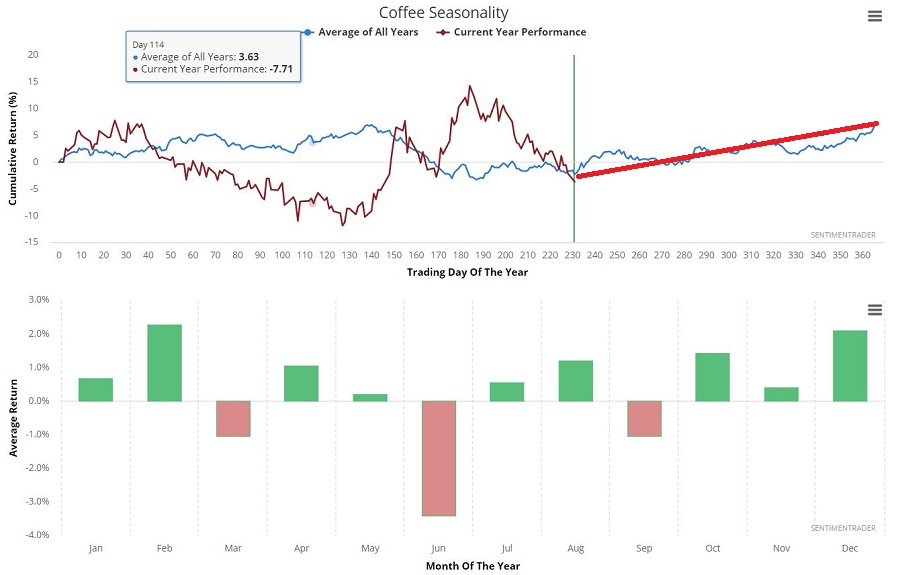

Figure 1 displays that Coffee tends to be stronger in the 2nd half of the year, and in theory anyway could be making a seasonal low in the near term. Figure 1 – Coffee futures seasonality (Courtesy Sentimentrader.com)

Figure 1 – Coffee futures seasonality (Courtesy Sentimentrader.com)

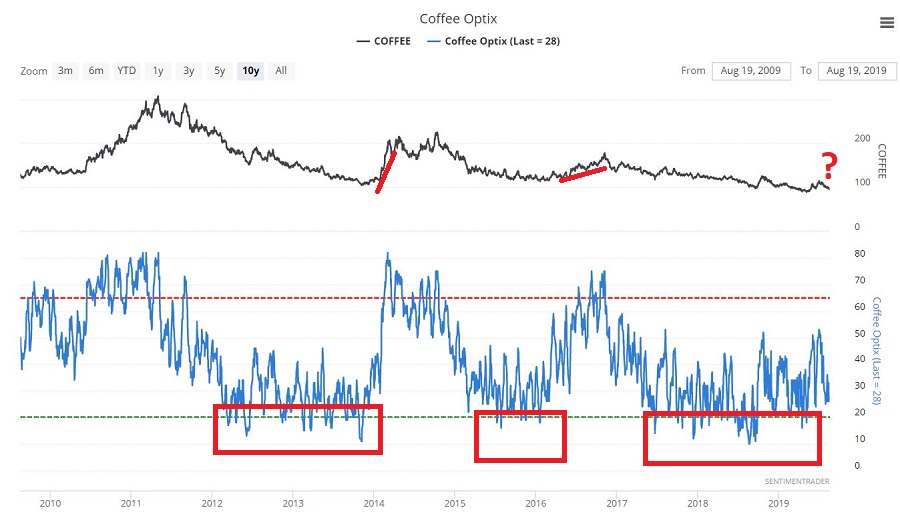

Figure 2 displays coffee trader sentiment recently coming off of a very low level. It is important to note (for all markets) that a “low” sentiment reading is NOT a “buy” signal. Fundamental supply and demand factors play a major role in price movement for physical commodities. But the bottom line is that “low” sentiment readings tend to presage the winding down of price declines (just as “high” sentiment readings tend to presage the winding down of price advances. Figure 2 – Coffee futures trader sentiment (Courtesy Sentimentrader.com)

Figure 2 – Coffee futures trader sentiment (Courtesy Sentimentrader.com)

Non-futures traders can trade shares of ticker JJOFF (iPath Bloomberg Coffee Subindex Total Return ETN) like they trade shares of stock (just note that average daily volume is quite low)

Cotton

I know, I know, you’re thinking “coffee and cotton, Jay – seriously?” Hey, I warned you we were going off the beaten path.

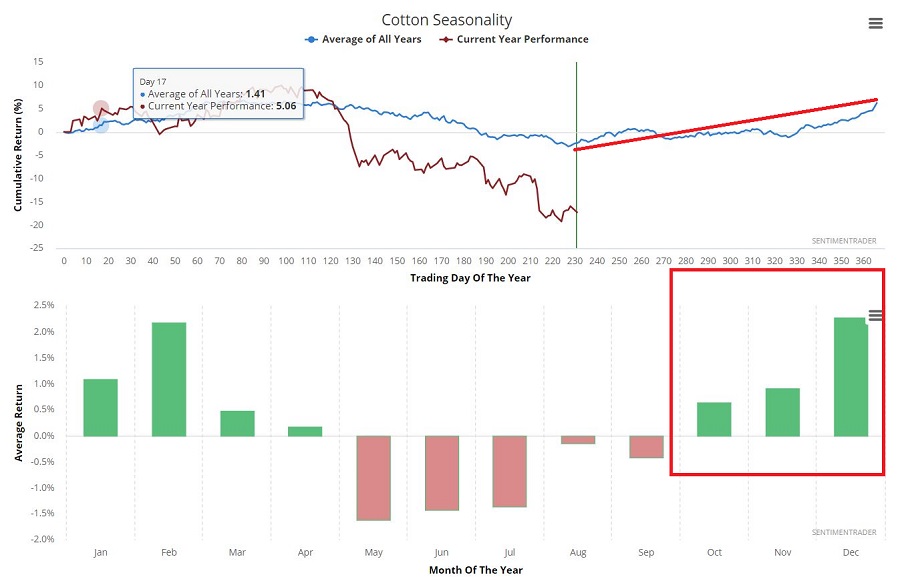

Figure 3 displays that on a seasonal basis, Cotton is “due” to bottom out (which importantly, does NOT mean that it will). Figure 3 – Cotton futures seasonality (Courtesy Sentimentrader.com)

Figure 3 – Cotton futures seasonality (Courtesy Sentimentrader.com)

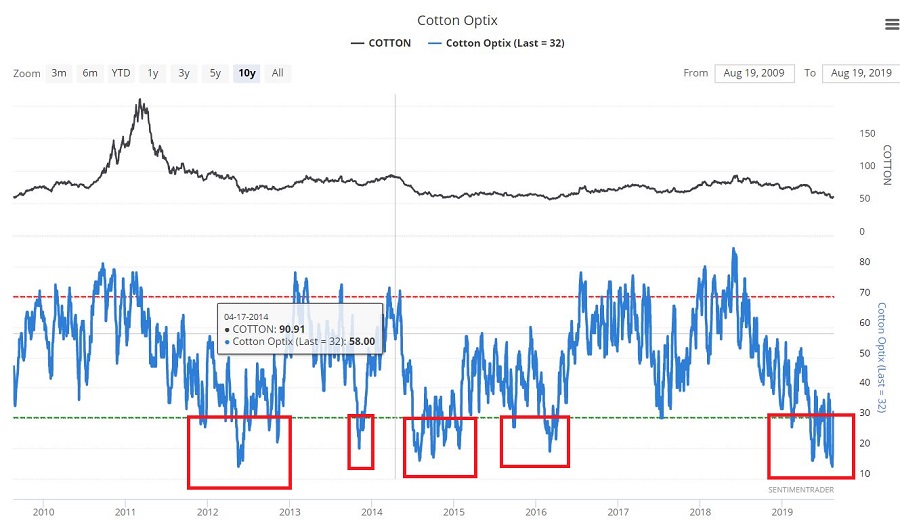

Figure 4 displays that Cotton traders have been hating Cotton a lot lately. As you can see in a close look at Figure 4, low readings do not necessarily presage big, long-term advances. But they do tend to highlight low-risk buying areas. Figure 4 – Cotton futures trader sentiment (Courtesy Sentimentrader.com)

Figure 4 – Cotton futures trader sentiment (Courtesy Sentimentrader.com)

Non-futures traders can trade shares of ticker BAL (iPath Series B Bloomberg Cotton Subindex Total Return ETN) like they trade shares of stock (here too, note that average daily volume is fairly low).

Euro

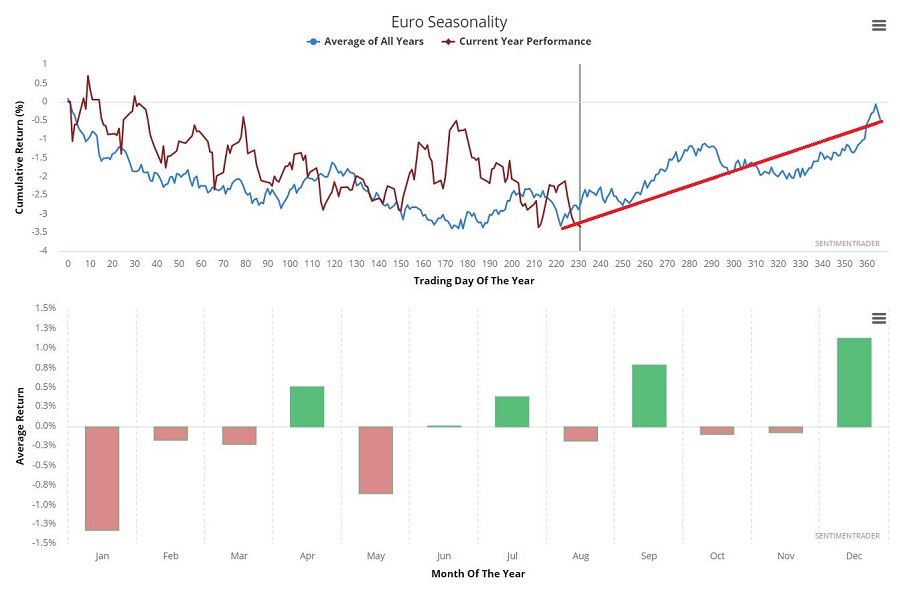

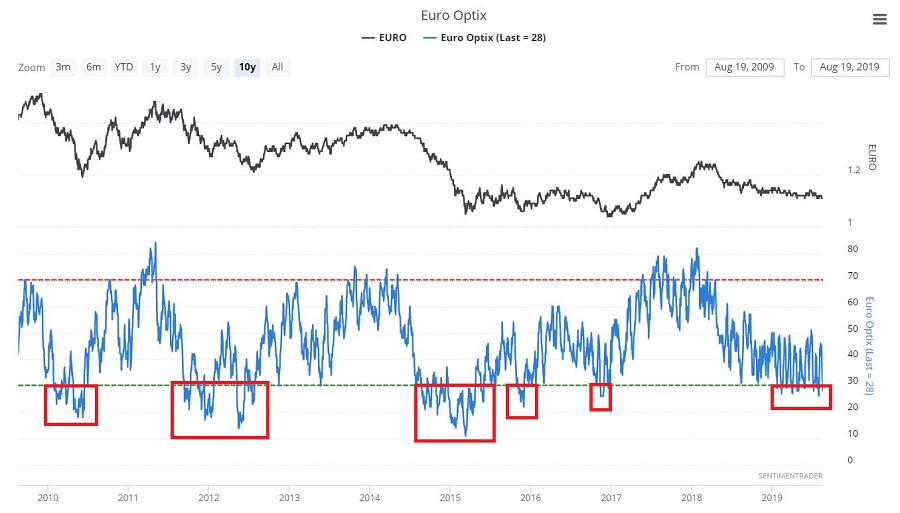

The U.S. Dollar has been extremely strong since January of 2018; hence the Euro has been quite week. Hence the reason this is such a very contrarian market to consider. But Figure 5 displays strong potential for a seasonal bounce in the Euro starting – essentially now. Figure 5 – Euro futures seasonality (Courtesy Sentimentrader.com)

Figure 5 – Euro futures seasonality (Courtesy Sentimentrader.com)

Figure 6 displays Euro futures trader bullish sentiment (and there isn’t a lot of it). Figure 6 – Euro futures trader sentiment (Courtesy Sentimentrader.com)

Figure 6 – Euro futures trader sentiment (Courtesy Sentimentrader.com)

Non-futures traders can trade shares of ticker FXE (Invesco CurrencyShares Euro Currency Trust) like they trade shares of stock (this ETF trades roughly 200K shares per day).

Natural Gas

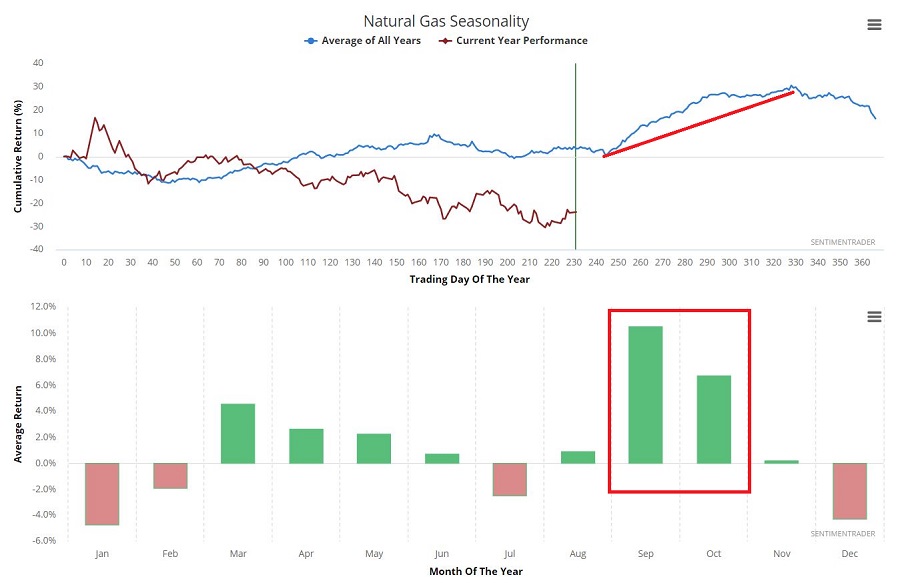

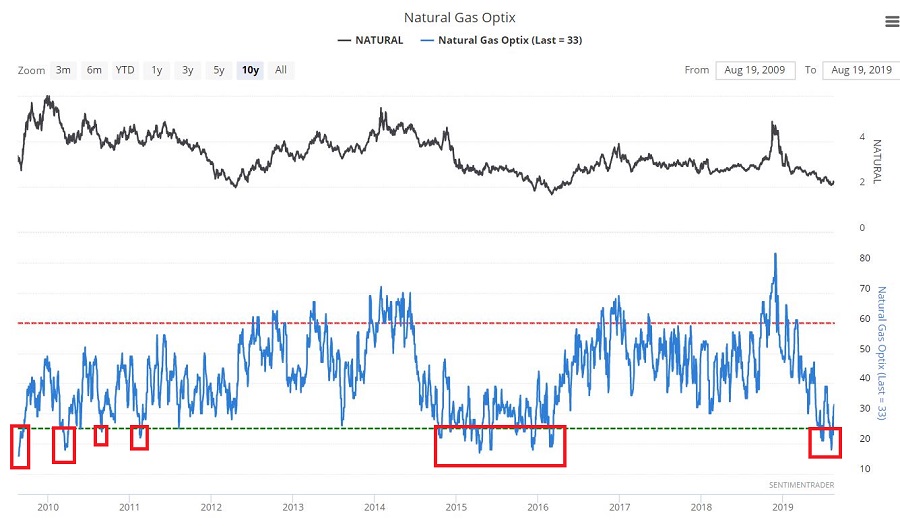

Historically September and October has been a favorable period for natural gas futures (although for the record, performance in the last several years has been rather muted). Figure 7 displays potential seasonal strength starting in early September. Figure 7 – Natural Gas futures seasonality (Courtesy Sentimentrader.com)

Figure 7 – Natural Gas futures seasonality (Courtesy Sentimentrader.com)

Figure 8 displays Natural Gas futures trader bullish sentiment. As with all the others listed in this article, Natural Gas has not been feeling a lot of love lately. Figure 8 – Natural Gas futures trader sentiment (Courtesy Sentimentrader.com)

Figure 8 – Natural Gas futures trader sentiment (Courtesy Sentimentrader.com)

Non-futures traders can trade shares of ticker UNG (United States Natural Gas Fund, LP) like they trade shares of stock (this ETF trades roughly 2 million shares per day).

Sugar

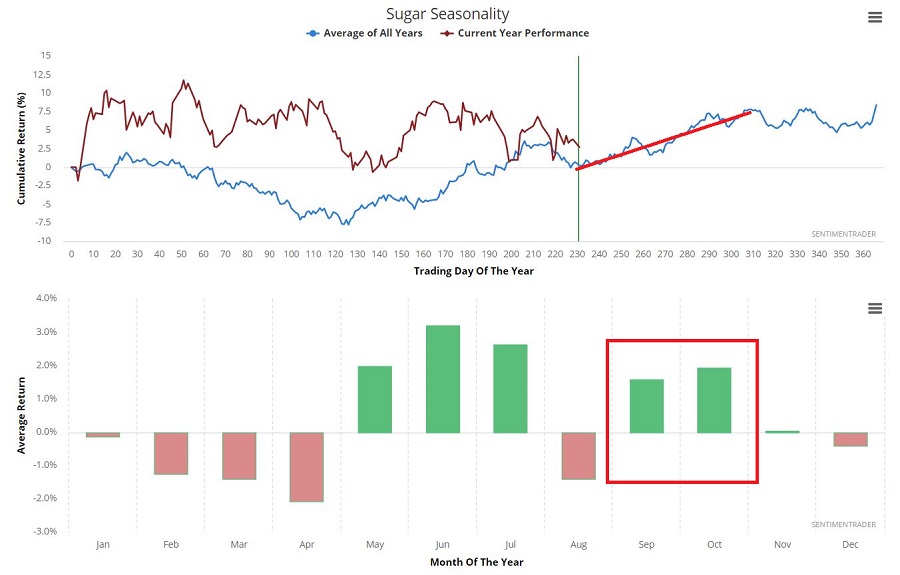

Rounding out our list of “markets that people love to hate and ignore” is what else, Sugar. Historically, Sugar has displayed a tendency to rally from basically now through the end of October (with one more caveat that with seasonal trends there is never any guarantee that things will work out “this time around”).

Figure 9 displays potential seasonal strength in the months ahead for Sugar. Figure 9 – Sugar futures seasonality (Courtesy Sentimentrader.com)

Figure 9 – Sugar futures seasonality (Courtesy Sentimentrader.com)

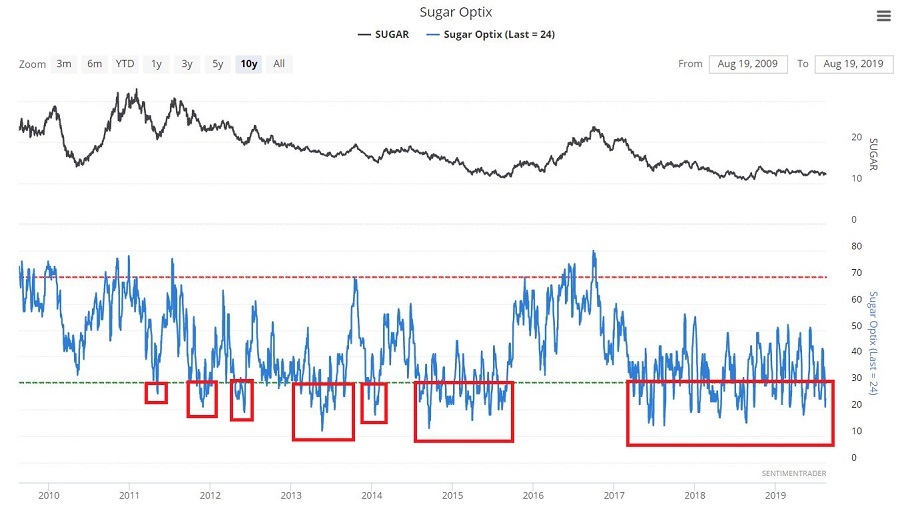

Figure 10 displays Sugar futures trader bullish sentiment. As you can see, Sugar has been out of favor for several years now (which in all fairness has been justified by the fact that fundamental factors have served to keep Sugar prices low. Is this about to change? It beats me. But the point is that if one is going to bet on Sugar, then when trader sentiment is bearish and the seasonal trend is bullish is as good a time as any. Figure 10 – Sugar futures trader sentiment (Courtesy Sentimentrader.com)

Figure 10 – Sugar futures trader sentiment (Courtesy Sentimentrader.com)

Non-futures traders can trade shares of ticker CANE (Teucrium Sugar) like they trade shares of stock.

Summary

Will any of the contrarian “ideas” pan out and witness higher prices in the months ahead. In all candor, it beats me. But that is the nature of contrarian investing and trading.

Is contrarian trading dead? I guess we’ll find out more in the months ahead.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.