Right off the bat, please notice that the headline reads “Summer Rally Zone” and NOT “Summer Rally”. I don’t have crystal ball (I used to, or so I thought. And believe me, in my youth I spent a lot of time staring into that da#$ thing before I realized it was broken) and cannot predict how things will work out “this time around.” But I can state categorically that we are about to enter in “the zone”.

The Summer Rally Zone

Historically, the SRZ (at least as I see it) encompasses:

*the last 3 trading days of June and

*the first 9 trading days of July.

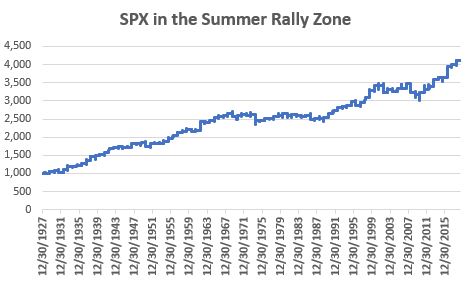

Figure 1 displays the growth of $1,000 invested in the S&P 500 Index ONLY during these 12 days every year starting in 1928.

Figure 1 – Growth of $!,000 in SPX during the Summer Rally Zone

The good news is that there is a clear long-term upside bias. The bad news is that there is no real way to know if the Summer Rally Zone will see SPX post a gain “this time.”

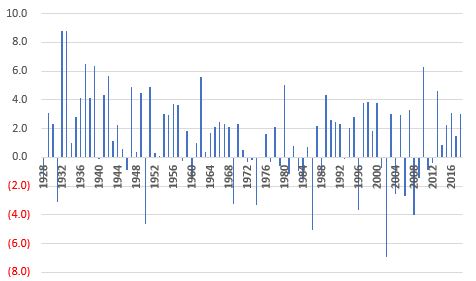

Figure 2 displays the year-by-year % +(-) in column form.

Figure 2 – SPX in the Summer Rally Zone year-by-year (1928-2018)

For the record:

*# times SRZ UP = 62 (68%)

*# times SRZ DOWN = 28 (31%)

*# times unchanged = 1

*Average UP SRZ% = +3.0%

*Average DOWN SRZ % = (-1.9%)

*Largest UP = +8.8% (1932 and 1933)

*Largest DOWN = (-6.9%) (2002)

So statistically speaking, we have a win/loss ratio of 2.21-to-1 and a winner to loser ratio of 1.57.

Statistically these are good numbers. But they certainly do NOT represent any kind of sure thing.

Summary

In 2019, the SRZ begins at the close on 6/25 and extends through the close on Friday 7/12.

If you are otherwise bullish on the market, this history suggests that now may be a good time to press your advantage. Just don’t construe that as some sort of “prediction” on my part.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.

You called it again!