2019 has been a terrible year for grain bulls. The typical first half seasonal strength in soybeans and corn has turned into a rout. Given the sharp downtrend combined with the fact that that typical seasonal strength is now about to turn into seasonal weakness, makes a very powerful case that grain bulls are “beaten” and should walk away.

And then that ol’ speculative devil on the other shoulder opens his big mouth.

Soybeans

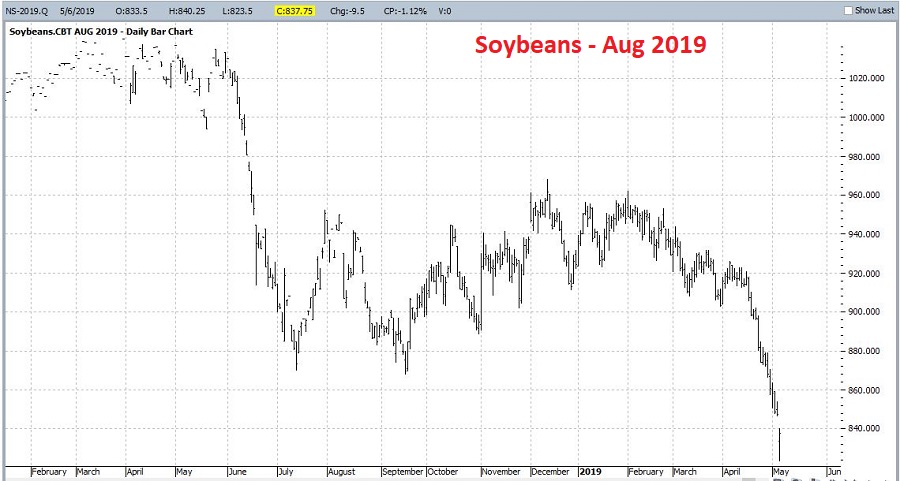

A quick glimpse of Figure 1 pretty much illustrates the devastation.

Figure 1 – August 2019 Soybean futures (Courtesy ProfitSource by HUBB)

Figure 1 – August 2019 Soybean futures (Courtesy ProfitSource by HUBB)

Trading wisdom is pretty clear that attempting to pick a bottom in anything is a fool’s game. And especially so when a security is in a relentless decline with no clear end in sight. But at some point things get overdone. There is some evidence that may be near that point with beans.

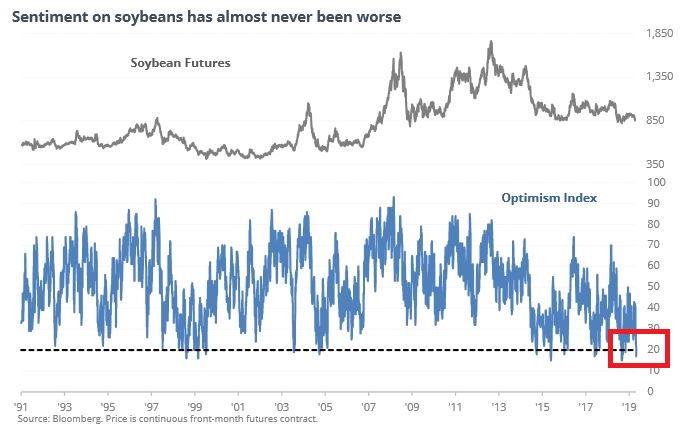

Figure 2 is from www.sentimentrader.com and shows that trader sentiment is about as bearish as it ever gets for the bean market. In other words, the bulls are finally throwing in the towel. As a contrarian signal, this type of capitulation has historically been short-term (2 months) bullish for beans. Figure 2 – Sentiment for Soybeans plummets (Courtesy: Sentimentrader.com)

Figure 2 – Sentiment for Soybeans plummets (Courtesy: Sentimentrader.com)

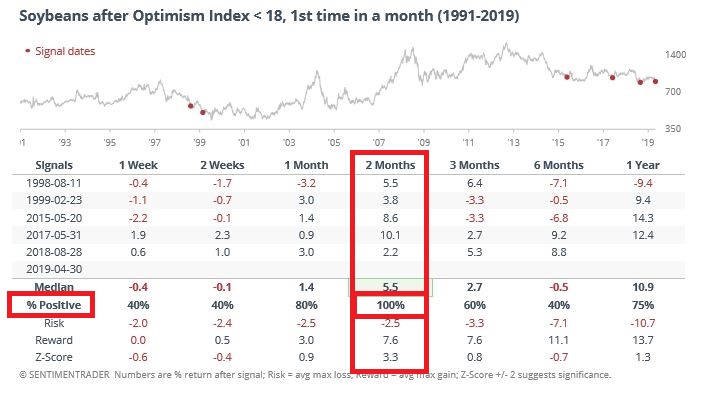

According to Sentiment Trader “With an Optimism Index at 16, we’re seeing some of the least optimism for any commodity in 29 years. For beans, only 15 other days since ’90 have seen optimism this low. According to the Backtest Engine, that preceded rebounds all 15 times two months later.” Figure 3 – Low optimism tends to be bullish for Beans over the next 2 months (Courtesy Sentimentrader.com)

Figure 3 – Low optimism tends to be bullish for Beans over the next 2 months (Courtesy Sentimentrader.com)

So, does this mean that soybeans are guaranteed to rally like crazy for the next two months and that we should pile in? Not at all. But it does suggest that an opportunity may exist for those “extreme speculative contrarians” (“Hi, my name is Jay”).

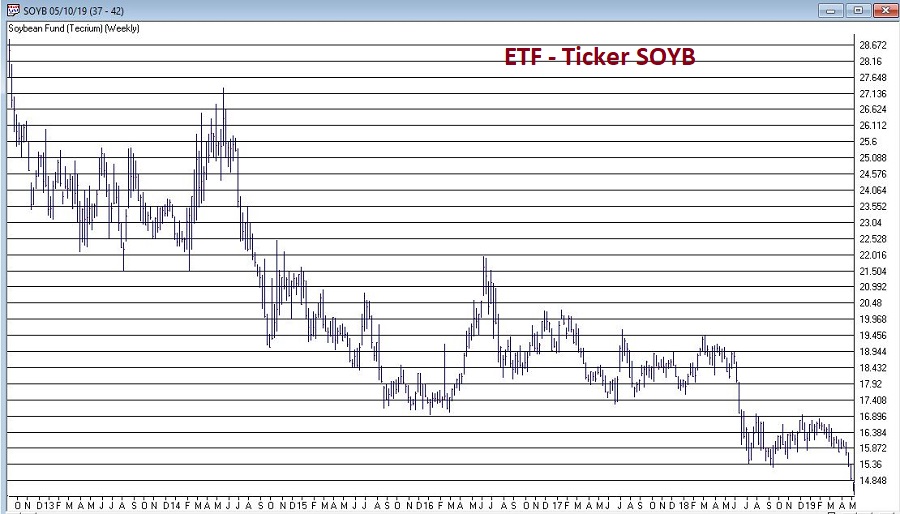

The purest play is to buy soybean futures. In reality, buying soybean futures is something that most trader will never – and should never – do. An alternative for “the rest of us” is an ETF ticker SOYB which is intended to track the price of soybean futures. As you can see in Figure 4, it has also been in a relentless decline for quite some time.

Figure 4 – ETF Ticker SOYB (Courtesy AIQ TradingExpert)

Figure 4 – ETF Ticker SOYB (Courtesy AIQ TradingExpert)

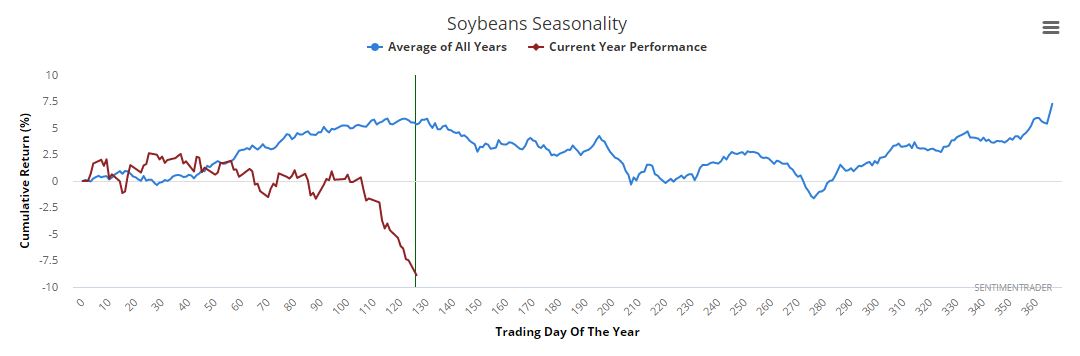

Buying shares of SOYB here is pretty much the definition of trying to catch a falling knife. To make matter worse, note in Figure 5 that the typical “bullish for beans” first part of the year has been a bust AND we are soon to enter the typically bearish part of the year. Figure 5 – Soybean annual seasonality (Courtesy Sentimentrader.com)

Figure 5 – Soybean annual seasonality (Courtesy Sentimentrader.com)

As I have said, a pretty good case can be made for NOT playing the bullish side of beans.

Still…..

….for that “wild-eyed speculator” this setup smacks of a short-term bottom:

*The relentless decline

*The big gap lower followed by an intraday reversal

*Sentiment at one of the lowest levels ever

So what to do? What follows is NOT a recommendation but simply one example of a way to play a (let’s be honest here, ridiculously) speculative situation. One possibility is to consider the August 14 strike price call option on ticker SOYB. The particulars appear at the top of Figure 6 and the risk curves appear at the bottom.  Figure 6 – SOYB Aug 14 strike price call (Courtesy www.OptionsAnalysis.com)

Figure 6 – SOYB Aug 14 strike price call (Courtesy www.OptionsAnalysis.com)

It should be noted with great caution that this option is very thinly traded and has an extremely wide bid/ask spread ($0.95/$1.15). For our purposes we assume Figure 6 that we get filled at the midpoint price of $1.05. This may or may not be possible.

But consider this:

*The trade cost $105 to enter (if filled at the midpoint, $115 is filled at the ask price), which is the maximum risk on the trade.

*If beans do in fact follow the historical trend of rallying in the next two months this option has the potential for a large percentage gain.

*If beans do in fact advance this option would enjoy point for point movement above $15.05 a share (SOYB is at $14.76 a share as this is written).

Summary

Is it a good idea to try to pick tops and bottoms? Generally speaking – absolutely not! Is it a good idea to try to pick a bottom now in soybeans? There is every chance that the answer is – absolutely not!

But markets go to extremes, and when traders “give up” on something that something often has a way of throwing everyone a curve and doing what no one expects.

That being said, the real point of all of this is simply that if you are going to “speculate” on something, put the emphasis on minimizing risk and NOT on maximizing profit.

If your “crazy idea” works out you will make plenty of money. That’s not the primary area of concern. The primary area of concern is ensuring that your “crazy idea” doesn’t completely blow up in your face.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.