When it comes to investing, opportunity is wherever you find it. And one of the keys to investing success is finding an “edge”, however slight. So let’s talk about a slight edge in the bond market.

The Period

Let’s look at the performance of long-tern treasuries only during the months of May through August compared to all 4-month periods.

For testing purposes we will use the Bloomberg Barclays Treasury Long Index monthly total return data starting in 1973.

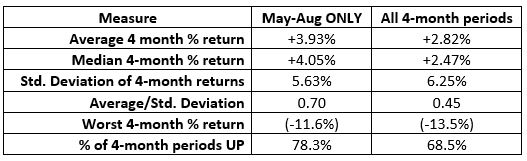

Figure 1 displays:

*Average 4 month return

*Median 4-month return

*Standard Deviation of 4-month returns

*Average 4-month return divided by standard deviation of 4-month returns (i.e., reward divided by volatility)

*Worst 4-month performance

*% of times the 4-month period showed a gain

Figure 1 – Long-Term Treasuries: May through August versus all 4-month periods; 1973-2019

As you can see, the May through August period has – on average – outperformed the “average” of all 4-months periods

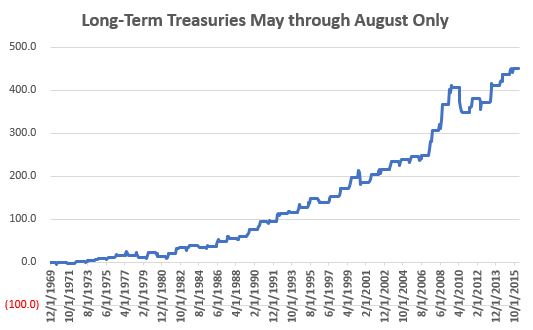

Figure 2 displays the cumulative growth of $1,000 invested in the index ONLY during May through August.

Figure 2 – Cumulative % return for LT Treasuries held May through August ONLY; 1973-2019

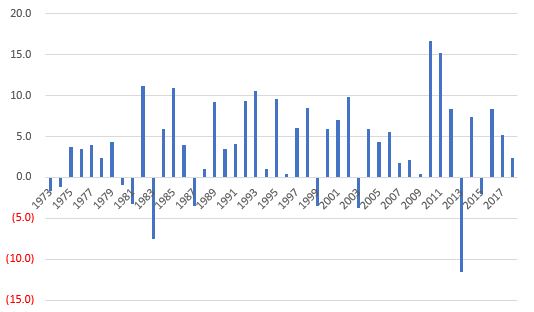

Figure 3 displays the year-by-year gain/loss for long-term treasuries during May through August.

Figure 3 – Year-by-year May through August; 1973-2019

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.