The purpose of this article is not really to talk about EBAY. The truth is I don’t really have an opinion about EBAY’s near-term prospects one way or the other. The real purpose of this article is to highlight the potential to make an inexpensive play (please note how I skillfully avoided the use of the word “bet”) on a given security via the use of options.

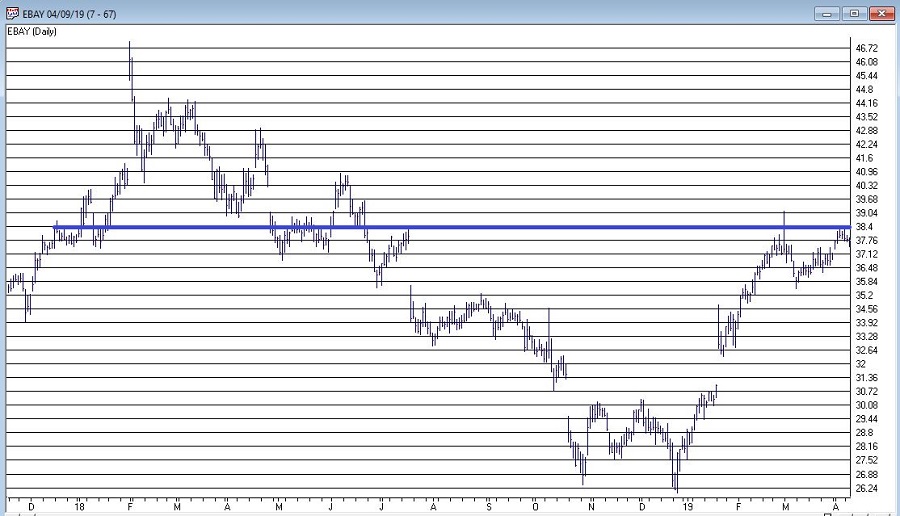

In Figure 1 we can see that EBAY has a had a pretty good run of late. In addition, if one wanted to one could make an argument that price is at or near a resistance level. Finally, earnings are due on or around 4/24.

Figure 1 – EBAY (Courtesy AIQ TradingExpert)

Figure 1 – EBAY (Courtesy AIQ TradingExpert)

So, let’s suppose a scenario where a trader felt that there was a decent chance that EBAY was going to “pause” in the current price area, and possibly pull back for at least a short period of time. This is not an out and out bearish projection, so buying a put option may not be the most optimal play.

So, let’s get creative.

The Example

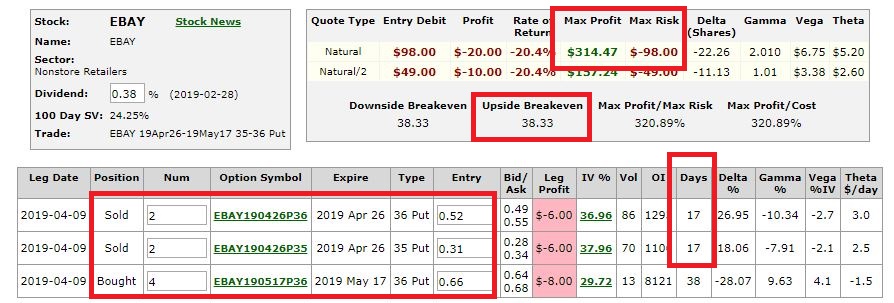

The example trade involves:

*Buying 4 EBAY May17 36 puts @ $0.66

*Selling 2 EBAY Apr26 36 puts @ $0.52

*Selling 2 EBAY Apr 26 35 puts @ $0.31

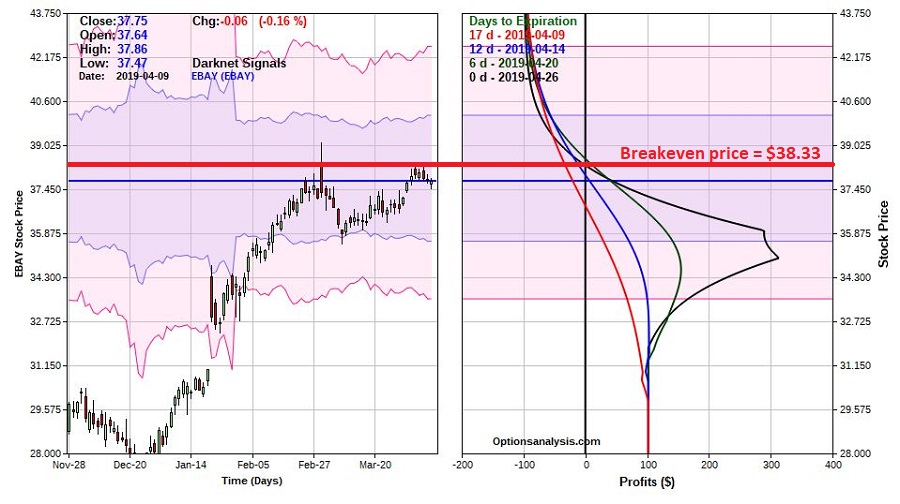

The particulars for this trade in Figure 2 and the risk curves in Figure 3. Figure 2 – EBAY Calendar Spread (Courtesy www.OptionsAnalysis.com)

Figure 2 – EBAY Calendar Spread (Courtesy www.OptionsAnalysis.com)

Figure 3 – EBAY Calendar Spread Risk Curves (Courtesy www.OptionsAnalysis.com)

Figure 3 – EBAY Calendar Spread Risk Curves (Courtesy www.OptionsAnalysis.com)

A few key things to note:

*The cost and maximum risk on this trade is $98. So, we are talking about some really cheap speculation here

*If EBAY does NOT pause – i.e., if it moves higher, a 100% loss of the entire $98 is the most likely outcome.

*If EBAY drifts sideways to slightly lower, this trade holds some decent profit potential on a percentage basis.

*If EBAY drops out of the sky, this trade can earn roughly 100% return on investment.

Summary

So, if this type of trade in general – and this EBAY trade in specific – even a good idea? That’s not for me to say. As I intimated above the purpose of this piece is simply to highlight the possibilities. But just to round out this particular example, the relevant questions in this case are:

1) Do you think EBAY may temporarily run out of steam and possibly experience a short-term pullback?

2) Do you have $98 bucks?

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.