In just 3 months and 2 days the OTC Composite Index is up over 18% so far in 2019. Given where things stood on Christmas Eve 2018 this has come as a surprise to most investors. But it should not have.

Based on research presented by Jeffrey Hirsch and The Stock Traders Almanac, we know that the OTC Composite Index has showed a historical tendency to exhibit strength from January 1st through the 10th trading day of July during pre-election years.

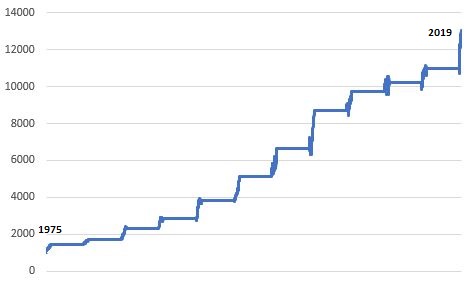

Figure 1 displays the hypothetical growth of $1,000 invested in the OTC Composite Index only during this roughly 6 and ½ month period of each pre-election year starting in 1975.

Figure 1 – Growth of $1,000 invested in OTC Composite Jan 1st through July Trading Day #10 of Pre-Election year

Hard to beat that for consistency. One thing to note is that during the last 3 previous pre-election years (2007, 2011, 2015) the total results were far less than in previous pre-election years.

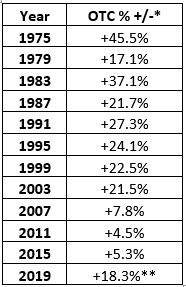

Figure 2 – Jan 1 through July Trading Day #10 during Election Years

*-Jan 1 through July Trading Day #10

**-Jan 1 through April 2, 2019

Is 2019 a “return to form”? Or is there trouble ahead?

As always, time will tell.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services,

Jay, what other books besides yours and this one would you recommend for calendar or cycle trading?

…I think you could make a book out of some of your blog posts, like this one.