This article is not for conservative, long-term buy and hold investors. Nevertheless, they should read this anyway. Because the steps that lead to profitable speculation are the same steps that lead to any kind of investment success.

The Big Picture

The keys to investment/trading success are fairly well know and can be summed up in two steps:

*Spot opportunity

*Exploit opportunity

To flesh it out a little more we might break it down further as follows:

*Identify an asset and develop an opinion about where the price of that asset might be headed (or not headed as the case may be with certain option strategies).

*Figure out which vehicle you want to use to exploit the opportunity (stock or ETF shares, futures contracts, options)

*Determine how much capital you can reasonably commit to said opportunity

*Also determine how much of that capital you are actually willing to risk

*Develop a risk control plan for the trade you are considering (ex., stop-loss point)

*Also consider what actions or events will lead you to close a trade with a profit (i.e., a trend reversal, a sharply overbought or oversold move in your direction) and think about whether you will exit the trade all at once, in stages, or in the case of options if you might adjust the position to lock in a profit and let the remaining position ride

The Reality

The reality is that most people don’t want to bother with all of these pesky steps. What they want is an indicator that says “Buy” and/or “Sell” that assures them of making money even if they aren’t mindful of “boring” things like position sizing, entry and exit techniques and so on.

Putting the Odds in Your Favor

One of the keys to exploiting good opportunities is to put as many “factors” in your favor as possible, to increase your likelihood of success. Rather than blathering on in generalities, let’s look at an actual example.

Focus on: Silver

Let’s face it, precious metals have a lot of sex appeal. On any given day you can easily find someone touting gold and/or silver and maybe platinum as “about to explode”. And the truth is that they have done so often enough in the past that it is always a possibility. Getting the timing right is a whole other matter.

IMPORTANT: I am NOT recommending silver and am not “predicting” that it is about to soar in price. However, as you will see, the current setup “fits the M.O.” of the type of setup that bullish speculators should look for. Whether or not this particular play pans out will only be known in the fullness of time.

In Figure 1 we see that silver has a long history of “coiling” and then “exploding”. If one considers the recent market action to be “coiling” (but remember it is one of those “in the eye of the beholder” situations) then it is not unreasonable to believe that a big up move is in the offing.

Figure 1 – Silver futures “coiling” (Courtesy ProfitSource by HUBB)

Figure 1 – Silver futures “coiling” (Courtesy ProfitSource by HUBB)

In Figure 2 we see a weekly chart of silver futures with a clear “line in the sand”. This type of horizontal line drawn objectively from a recent low serves an important purpose to a speculator. It represents an “uncle” point. As long as price remains above the red line it can make sense for a speculator to speculate on the bullish side. However, if that price is taken out the trader must be willing to admit “I’m wrong” and cut a loss (Hint: that is often harder to do than most people care to admit). Figure 2 – Silver futures with a “support/line in the sand/uncle point” line (Courtesy ProfitSource by HUBB)

Figure 2 – Silver futures with a “support/line in the sand/uncle point” line (Courtesy ProfitSource by HUBB)

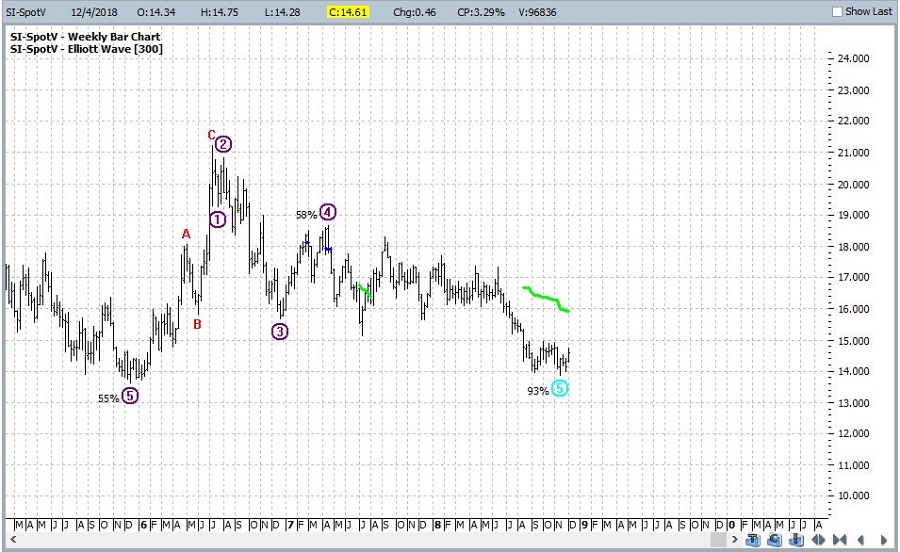

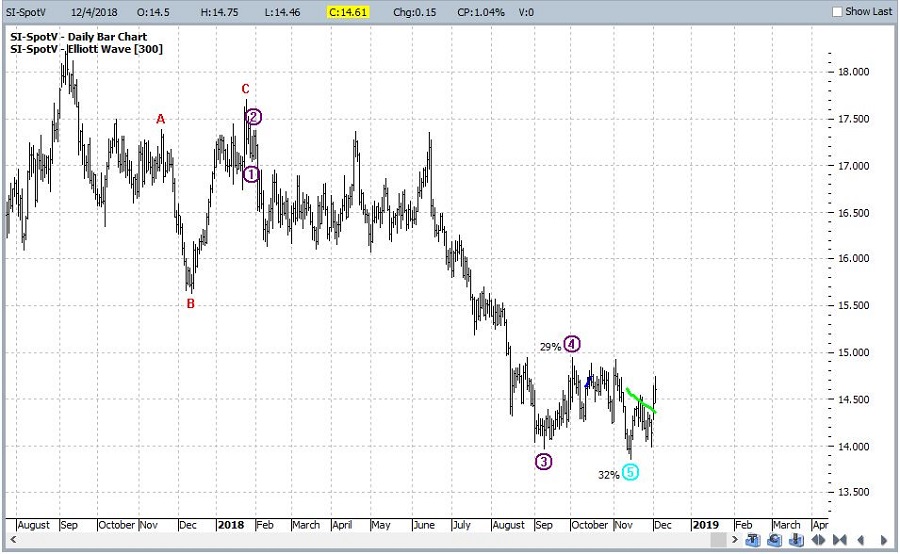

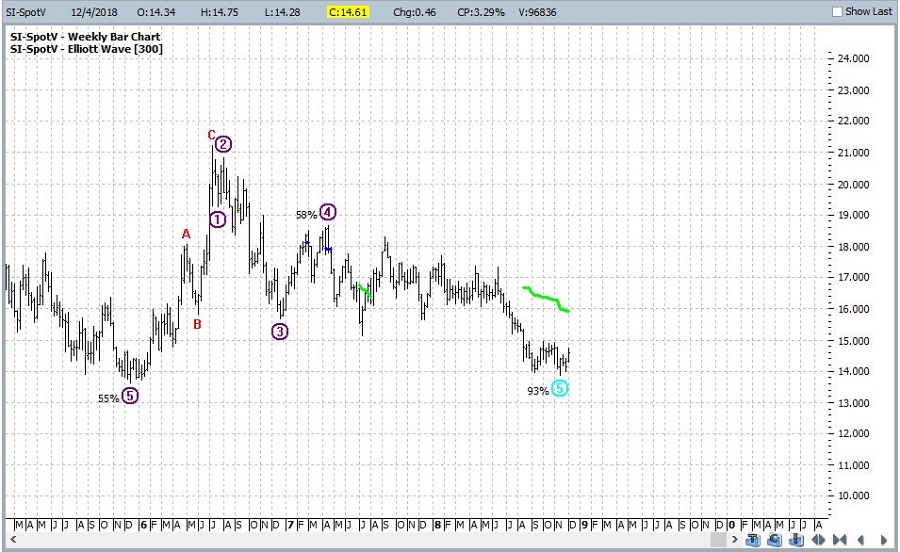

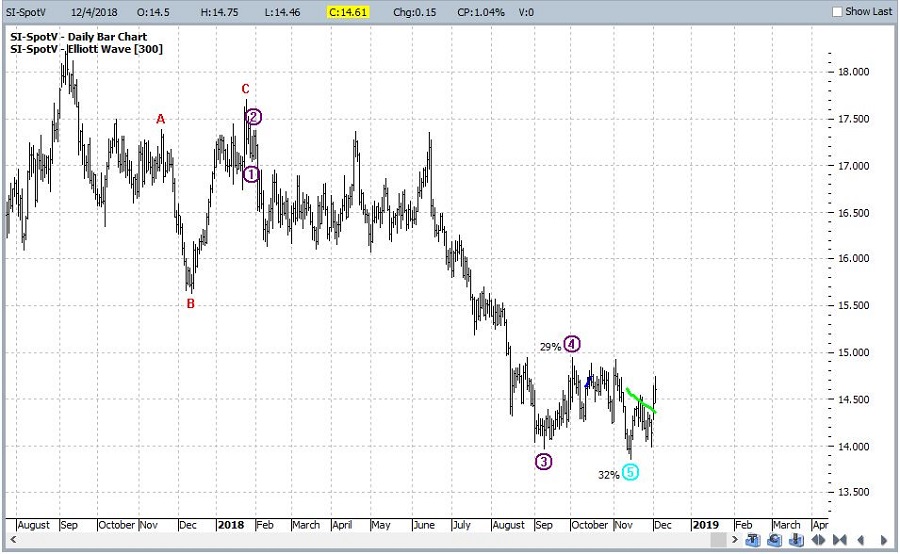

Figures 3 and 4 display the Weekly and daily Eilliot Wave counts for silver futures from ProfitSource by HUBB. Note that both are suggesting a potential Wave 5 bottom.

Figure 3 – Weekly Silver futures with Elliott Wave count (Courtesy ProfitSource by HUBB)

Figure 3 – Weekly Silver futures with Elliott Wave count (Courtesy ProfitSource by HUBB)

Figure 4 – Daily Silver futures with Elliot Wave count (Courtesy ProfitSource by HUBB)

Figure 4 – Daily Silver futures with Elliot Wave count (Courtesy ProfitSource by HUBB)

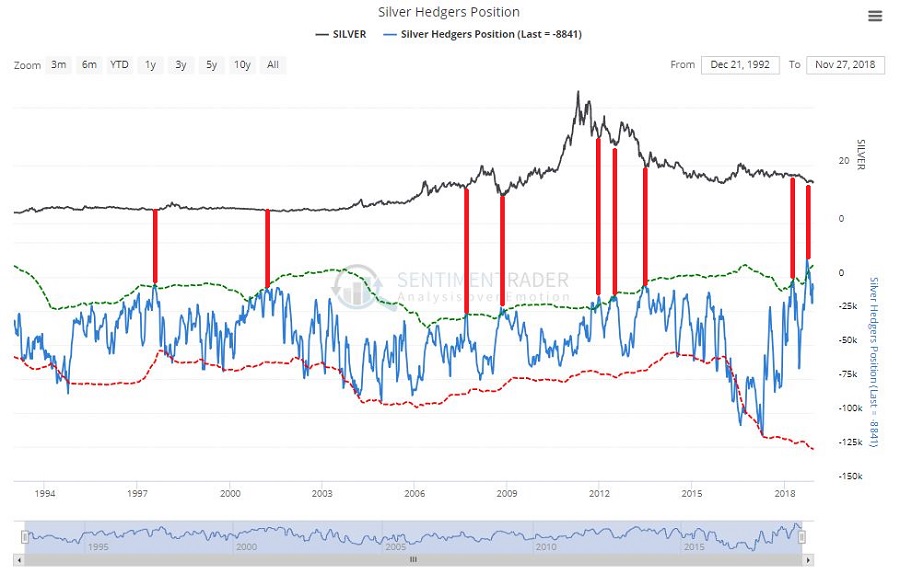

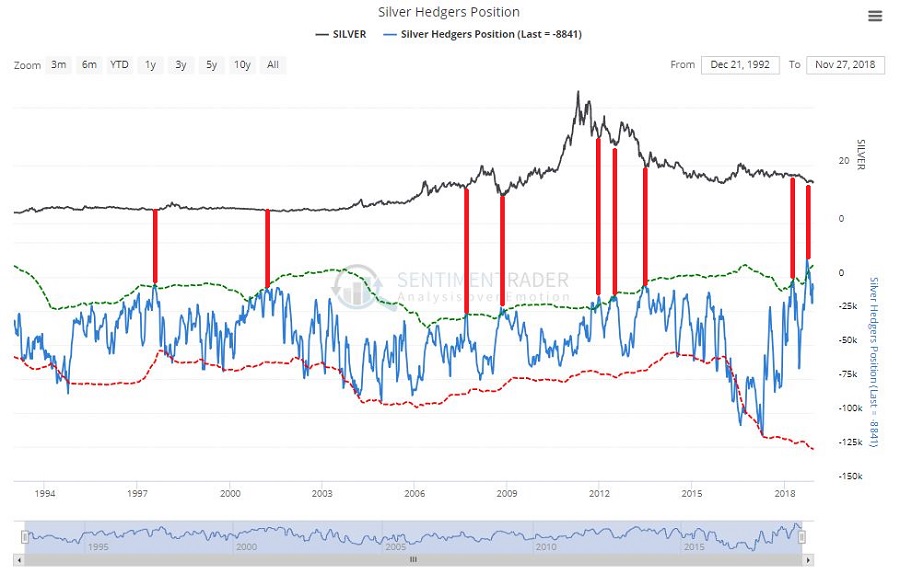

Figure 5 is from www.sentimentrader.com and displays the action of hedgers in silver futures. Note that “spikes” above the upper band often (though – importantly – not always) identify useful buying points. Figure 5 – Silver futures and Silver Hedgers Position (Courtesy Sentimentrader.com)

Figure 5 – Silver futures and Silver Hedgers Position (Courtesy Sentimentrader.com)

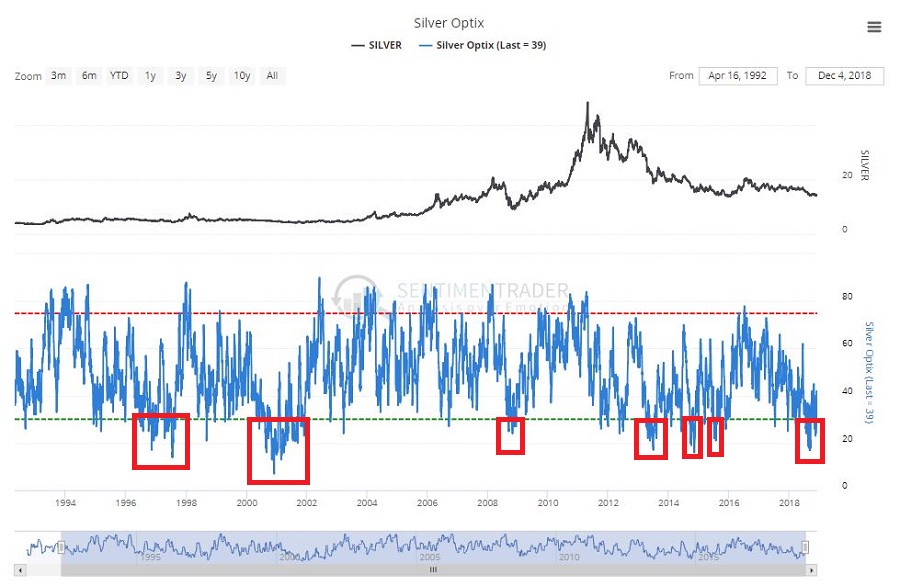

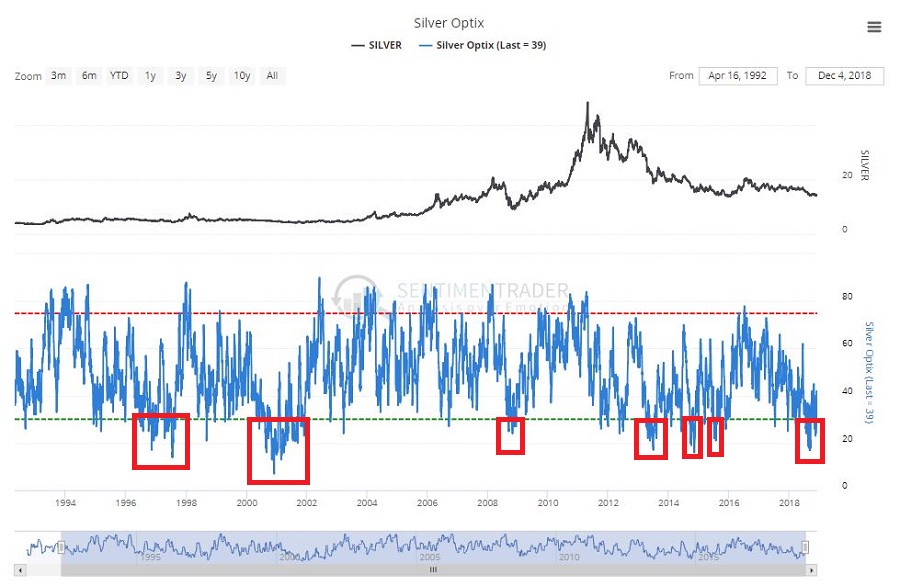

Figure 6 displays silver futures with trader sentiment. Note that extended periods below the lower cutoff (i.e., bearish traders) tend to highlight lower risk buying opportunities (Courtesy Sentimentrader.com). Figure 6 – Silver futures and Silver trader sentiment (Courtesy Sentimentrader.com)

Figure 6 – Silver futures and Silver trader sentiment (Courtesy Sentimentrader.com)

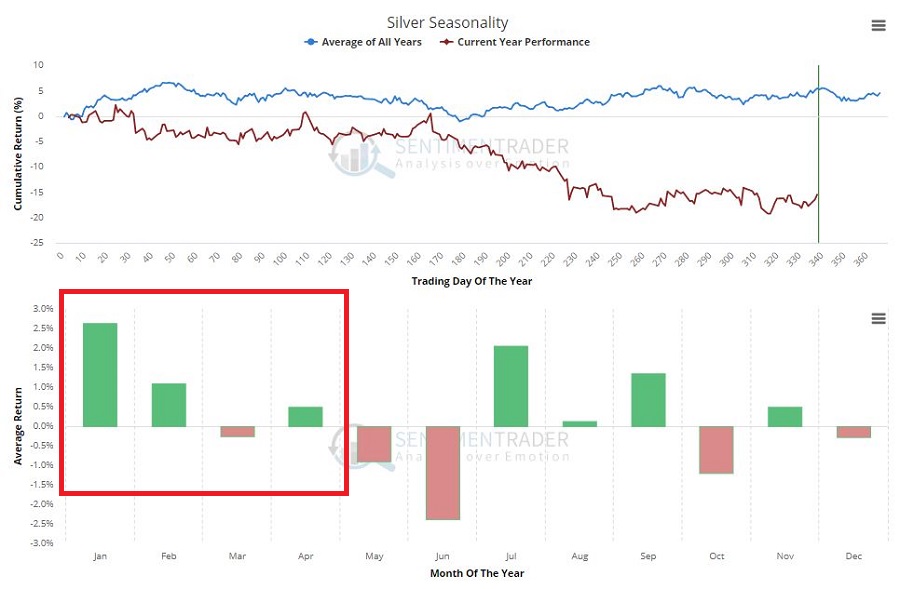

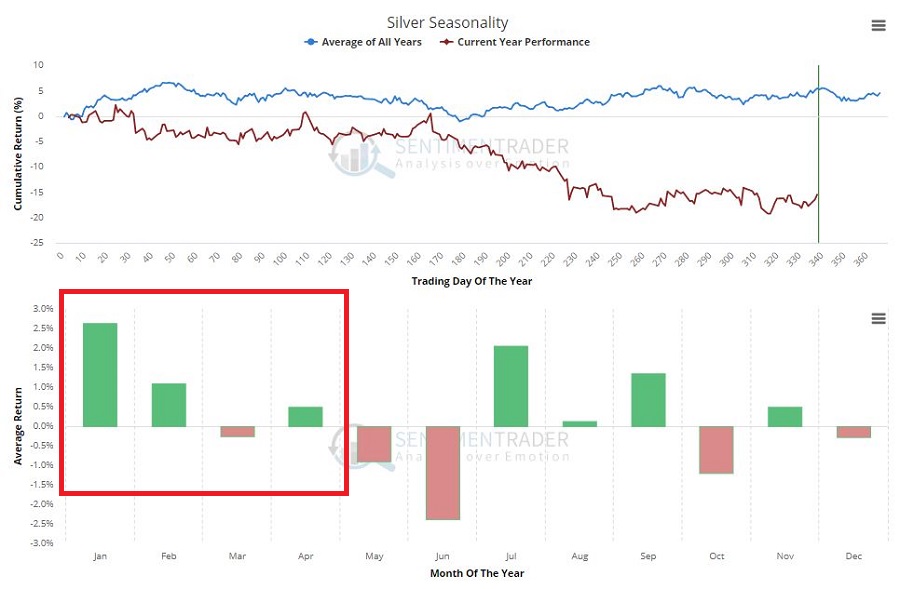

Finally Figure 7 displays annual seasonality for silver. One concern is that silver tends to show weakness in December. On the plus side January is historically the best month of the year overall and the 1st four months of the year tend to perform well. Figure 7 – Silver futures and Silver seasonality (Courtesy Sentimentrader.com)

Figure 7 – Silver futures and Silver seasonality (Courtesy Sentimentrader.com)

The bottom line is that a lot of factors appear to be lining up on “the bullish side of the street” for silver. Does that mean it is about to “explode” higher? Or even go up at all? The correct answer is “Maybe, maybe not. ” The relevant questions are, a) do you want to play?, and 2) if “Yes”, then “how”?

What to do, what to do?

For a person willing to speculate there are number of potential courses of action.

*The first decision might be to decide whether to take the plunge now or to wait until closer to mid-December when the annual seasonal trend bottoms out.

*If one decides to act the next question to answer is “how” – or more accurately – “using which vehicle”. The purest speculative play is to buy silver futures. However, this entails a significant degree of risk as a $1 move in the price of silver represents a $5,000 change in the value of the futures contract. Another possibility is to buy shares of ETF ticker SLV which tracks the price of silver bullion. Trading at $13.48 a share, 100 shares would cost $1,348. One other choice might be to buy call options on ticker SLV in order to limit the capital commitment and dollar risk. Let’s consider one example.

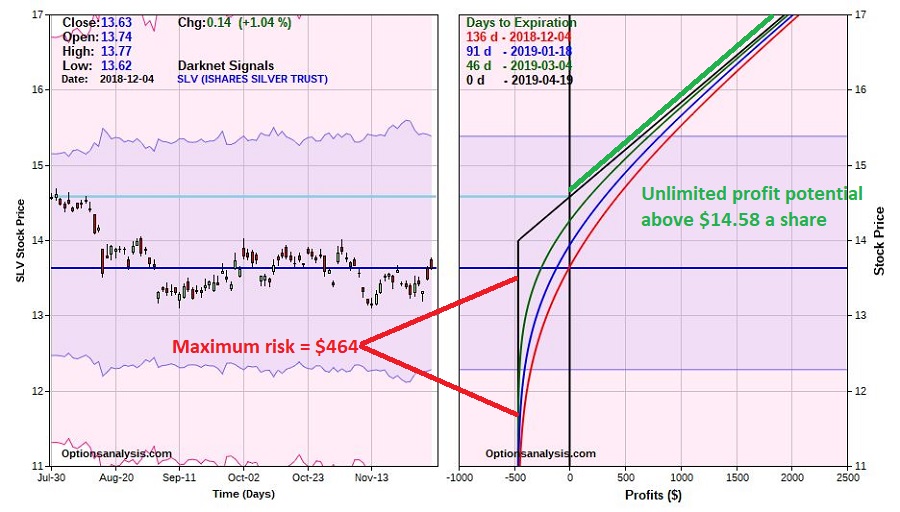

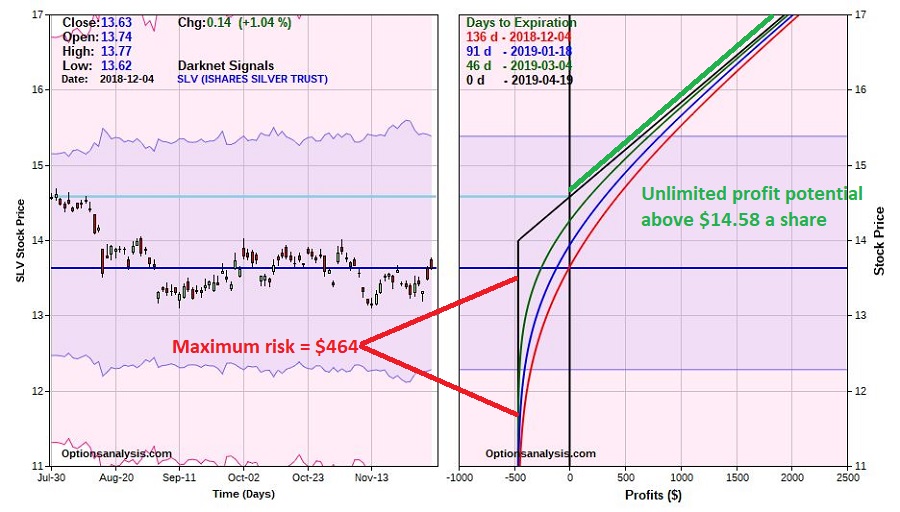

*A trader with a $25,000 account might decide he or she is willing to risk 2% of their capital on a bullish play in silver. The April 2019 14 call option is trading at a quoted price of $0.58 (or $58 per contract). $25000 times 2% = $500. $500 divided by $58 per contract tells us that the trade can buy 8 call options for $464. The details for this trade appear in Figures 8 and 9. Figure 8 – SLV call option details (Courtesy www.OptionsAnalysis.com)

Figure 8 – SLV call option details (Courtesy www.OptionsAnalysis.com)

Figure 9 – SLV call option risk curves (Courtesy www.OptionsAnalysis.com)

Figure 9 – SLV call option risk curves (Courtesy www.OptionsAnalysis.com)

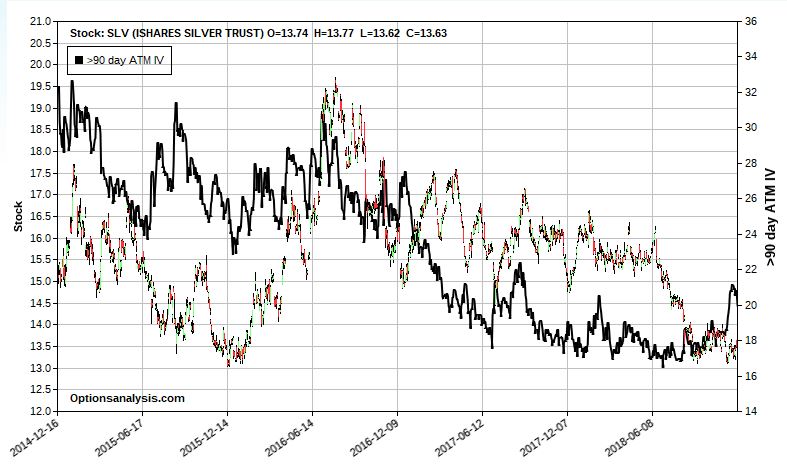

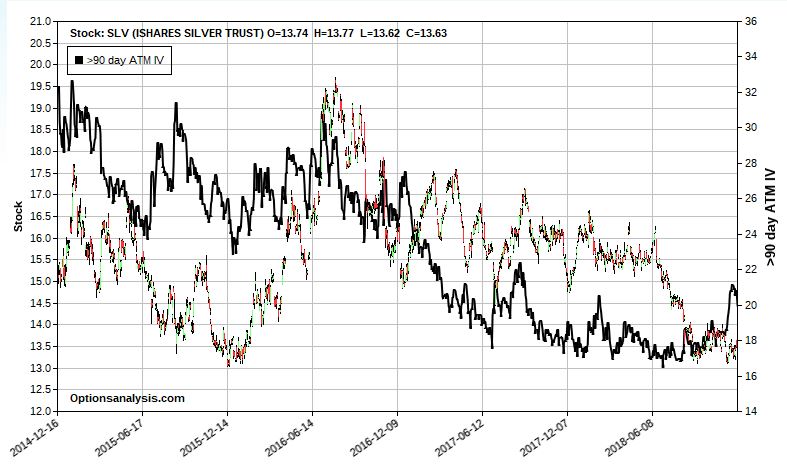

Again, the trade above is NOT a recommendation, only an example. And for the record, one other concern (besides the potential for seasonal weakness) is that implied volatility on SLV options jumped in the last week (see Figure 10). If SLV drifts sideways to slightly lower into mid-December (and assuming the “line in the sand” is not taken out, there is a chance that IV will drift lower also, thus deflating the about of time premium built into SLV options.

Figure 10 – Ticker SLV with 90+ day implied volatility (black line) (Courtesy www.OptionsAnalysis.com)

Figure 10 – Ticker SLV with 90+ day implied volatility (black line) (Courtesy www.OptionsAnalysis.com)

From a tactical standpoint it might make sense to be patient and a) see if IV settles down, b) silver futures and SLV hold above the recent low, and c) the period of seasonal weakness passes.

Summary

The purpose of this article is NOT to convince you to speculate in SLV. The purpose is simply to highlight a potential “process” for spotting and exploiting opportunity.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.

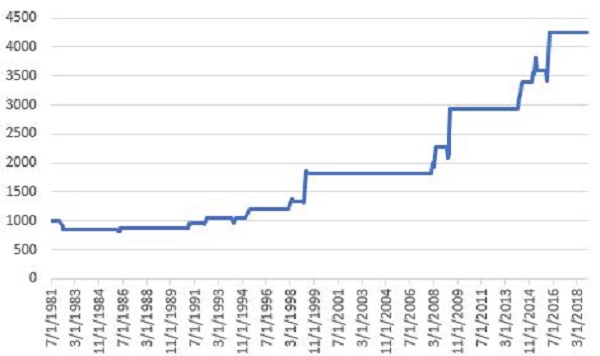

Figure 1 – Growth of $1,000 invested in FSENX ONLY during Feb-May ONLY IF Nov-Jan shows a loss

Figure 1 – Growth of $1,000 invested in FSENX ONLY during Feb-May ONLY IF Nov-Jan shows a loss Figure 3 – Ticker XLE (Courtesy AIQ TradingExpert)

Figure 3 – Ticker XLE (Courtesy AIQ TradingExpert)