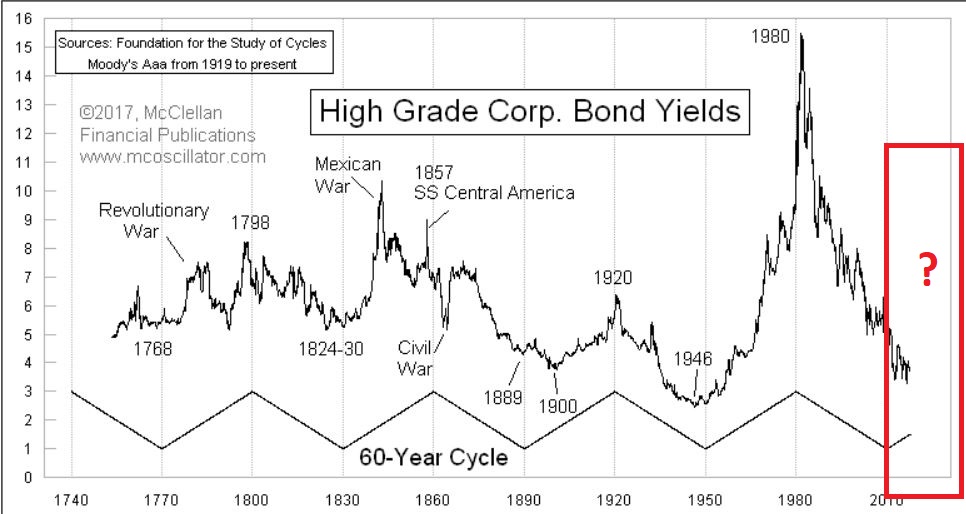

OK, first the bad news. In terms of the long-term, we are probably in the midst of a rising interest rate environment. Consider the information contained in Figure 1 from McClellan Financial Publications.

(click to enlarge) Figure 1 – The 60-year cycle in interest rates (Courtesy: www.mscoscillator.com)

Figure 1 – The 60-year cycle in interest rates (Courtesy: www.mscoscillator.com)

Though no cycle is ever perfect, it is only logical to look at Figure 1 and come away thinking that rates will rise in the years (and possibly decades) ahead. And one should plan accordingly, i.e.:

*Eschew large holdings of long-term bonds. Remember that a bond with a “duration” -Google that term as it relates to bonds please – of 15 implies that if interest rates rise 1 full percentage point then that bond will lose roughly 15% of principal. Ouch.

*Stick to short to intermediate term bonds (which will reinvest at higher rates more quickly than long-term bonds as rates rise) and possibly some exposure to floating rate bonds.

That is “The Big Picture”.

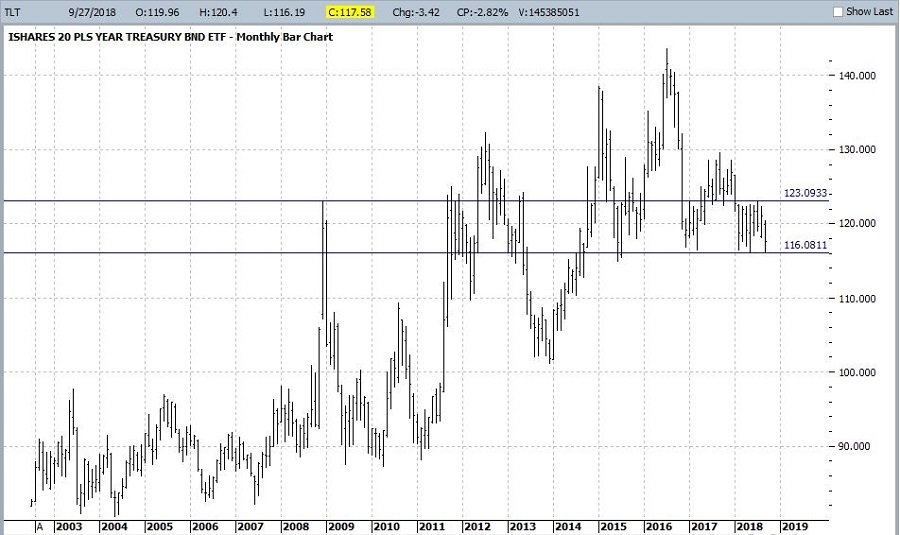

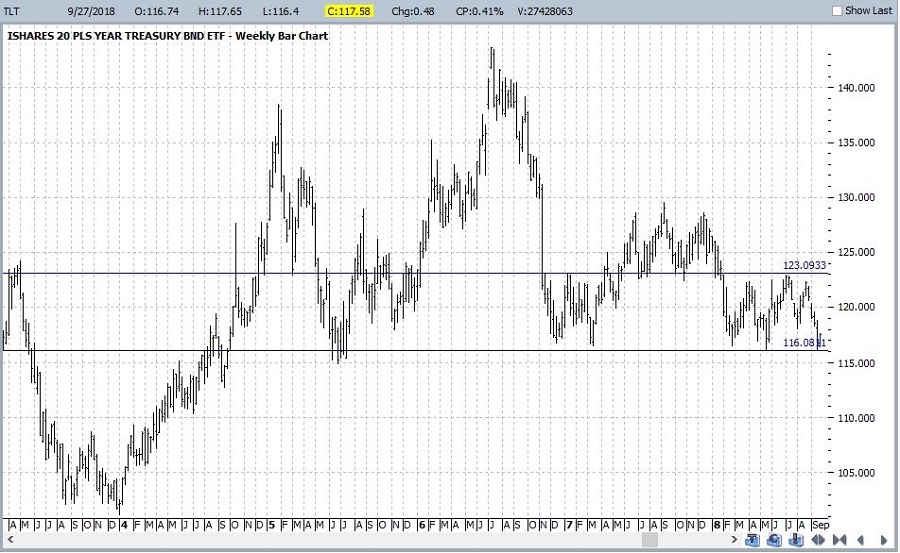

In the meantime, there is a potential bullish case to be for bonds in the shorter-term. The “quick and dirty” guide to “where are bonds headed next” appears in the monthly and weekly charts of ticker TLT (iShares 20+ years treasury bond ETF). Note the key support and resistance levels drawn on these charts.

(click to enlarge) Figure 2 – Monthly TLT with support and resistance (Courtesy ProfitSource by HUBB)

Figure 2 – Monthly TLT with support and resistance (Courtesy ProfitSource by HUBB)

(click to enlarge) Figure 3 – Weekly TLT with support and resistance (Courtesy ProfitSource by HUBB)

Figure 3 – Weekly TLT with support and resistance (Courtesy ProfitSource by HUBB)

There is nothing magic about these lines, but a break above resistance suggests a bull move, a break below support suggests a bear move, and anything in between suggests a trading range affair.

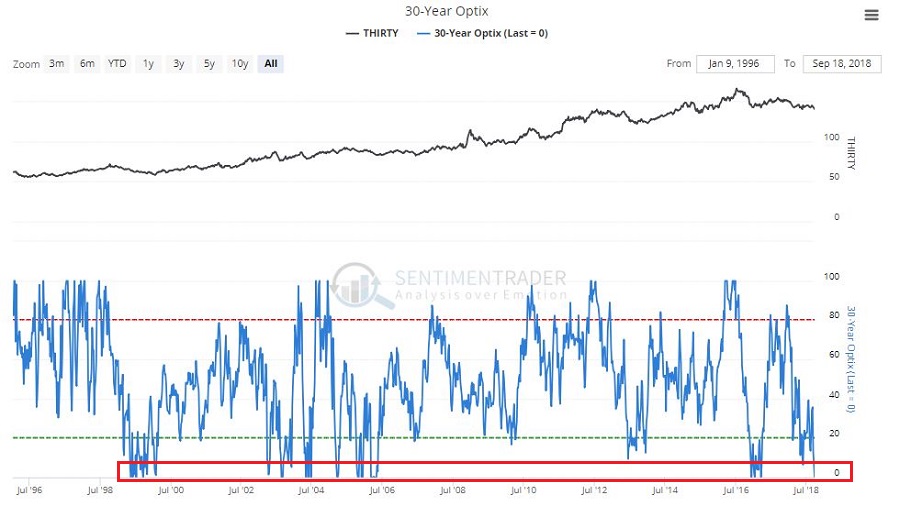

Now let’s look at some potentially positive influences. Figure 4 displays a screen from the excellent site www.sentimentrader.com that shows that sentiment regarding the long treasury bond is rock bottom low. As a contrarian sign this is typically considered to be bullish.

(click to enlarge) Figure 4 – 30-year treasury investor sentiment is extremely low (Courtesy Sentimentrader.com)

Figure 4 – 30-year treasury investor sentiment is extremely low (Courtesy Sentimentrader.com)

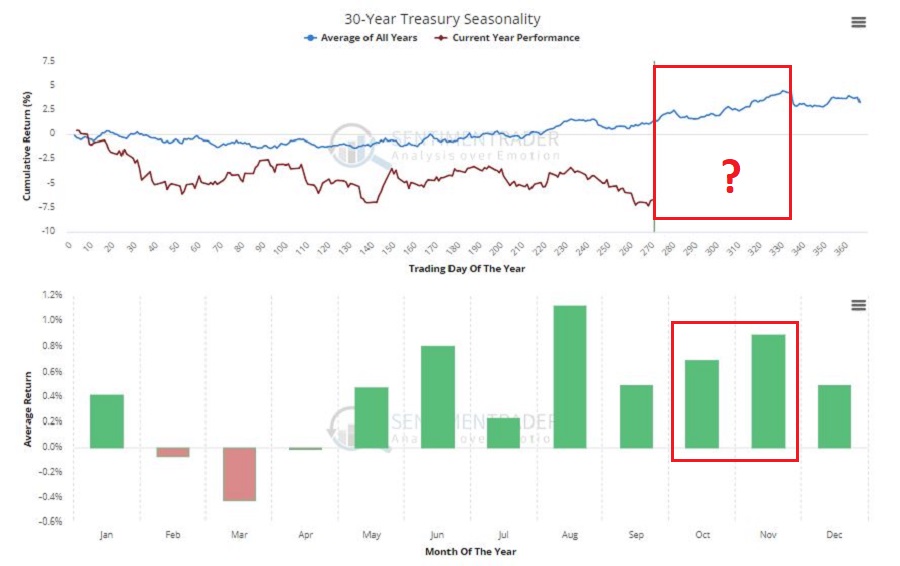

Figure 5 – also from www.sentimentrader.com – suggests that bonds may be entering a “bullish” seasonal period between now and at least late-November (and possibly as long as late January 2019).

(click to enlarge) Figure 5 – 30-year treasury seasonality (Courtesy Sentimentrader.com)

Figure 5 – 30-year treasury seasonality (Courtesy Sentimentrader.com)

Figure 6 displays the 30-year treasury bond yield (multiplied by 10 for some reason). While rates have risen 27% from the low (from 2.51% to 3.18%), they still remain below the long-term 120-month exponential moving average.

(click to enlarge) Figure 6 – Long-term treasury bond yields versus 120-month moving average (Courtesy AIQ TradingExpert)

Figure 6 – Long-term treasury bond yields versus 120-month moving average (Courtesy AIQ TradingExpert)

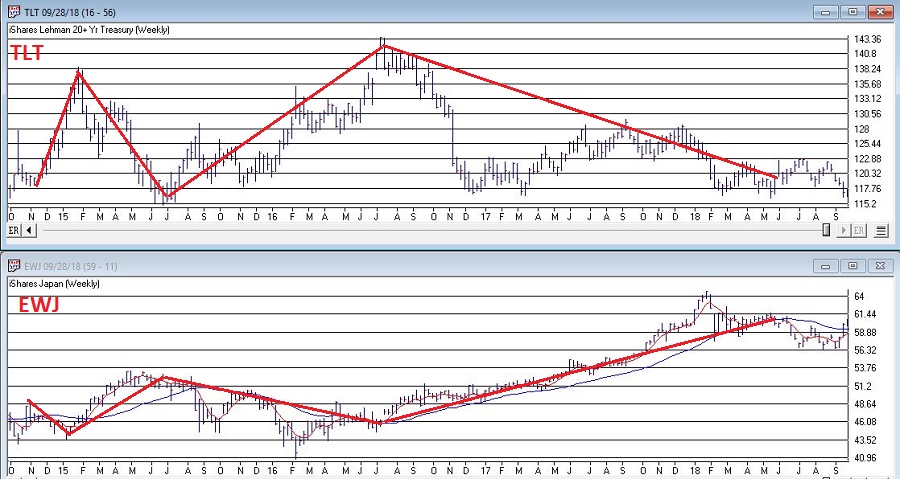

Finally, two systems that I developed that deems the bond trend bullish or bearish based on the movements of 1) metals, and 2) Japanese stocks turned bullish recently. The bond market has fallen since these bullish signal were flashed – possibly as a result of the anticipated rate hike from the Fed. Now that that hike is out of the way we should keep a close eye on bonds for a potential advance in the months ahead.

(click to enlarge) Figure 7 – Bonds tend to move inversely to Japanese stocks; Ticker EWJ 5-week average is below 30-week average, i.e., potentially bullish for bonds (Courtesy AIQ TradingExpert)

Figure 7 – Bonds tend to move inversely to Japanese stocks; Ticker EWJ 5-week average is below 30-week average, i.e., potentially bullish for bonds (Courtesy AIQ TradingExpert)

Summary

It’s a little confusing here.

a) The “long-term” outlook for bonds is very “iffy”, so bond “investors” should continue to be cautious – as detailed above.

b) On the other hand, there appears to be a chance that bonds are setting up for a rally in the near-term.

c) But, in one final twist, remember that if TLT takes out its recent support level, all bullish bets are off.

Are we having fun yet?

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.