Some days are better than others. Boy, are there any truer words than those? And this phrase holds true for many, many things. You know, like treasury bonds for example.

Good Days in Bonds

I define “Good Days” in bonds as:

*Trading Days of the Month #10, 11 and 12

*The last 5 trading days of each month

It may not be fair to designate all other days of the month as “Bad” – but as you will see, they certainly aren’t “Good”. So, for testing purposes we will go ahead and refer to them as “Bad Days”

For testing purposes:

*We will look at the daily dollar value change in the U.S. treasury bond futures contract (each full point is worth $1,000 – so if t-bond futures rise one day from 120 to 121, the value of the contract increases by $1,000) to track results during “Good Days” only, “Bad Days” only and “All Days”, i.e., Buy-and-Hold.

*We will total up the cumulative $ gain/loss for all the Good Days

*We will total up the cumulative $ gain/loss for all the Bad Days

*Our test extends from 12/31/194 through 8/31/2018

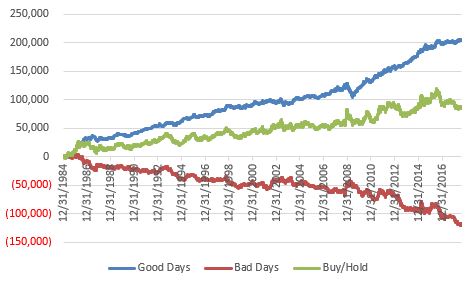

In Figure 1, the blue line represents the cumulative $ gain of the “Good Days” and the red line represents the cumulative $ loss of the “Bad Days” and the green line represents and holding a long position in a t-bond futures contract continuously.

Figure 1 – Good Days (blue) versus Bad Days (red) versus Buy-and-Hold (green) based on daily $+(-) for treasury bond futures; 12/31/194-8/31/2018

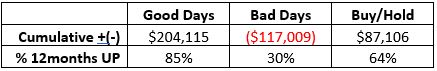

For the record:

Figure 2 – Good Days versus Bad Days and Buy and Hold (1231/1983-8/31/2018)

Of course, we operate in a “What Have You Done for Me Lately?” business. So, it is fair to ask, how have Good Days/Bad Days” fared since the bond market hit rough water a while back. So let’s take a look.

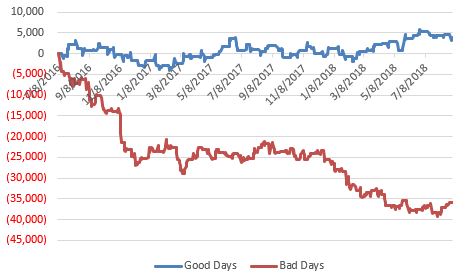

The long-term treasury bond topped out on 7/8/2016. Figure 3 displays the cumulative gain/loss from holding a long position in t-bond futures on Good Days versus Bad Days since that date.

Figure 3 – Good Days (blue) versus Bad Days (red) since t-bonds topped out on 7/8/2016

As you can see, on an absolute basis, Good Days haven’t been all that great. Still, they have eked out a gain (+$3,627) and on a relative basis have vastly outperformed Bad Days (which have lost -$35,877).

Have a Good Day.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.

Under the heading “Good Days in Bonds” did you mean “the last 5 trading days of each month” rather than “The five trading days of each month”?

Paul, Yes, of course, thanks for the catch! Sheesh, how did I miss that one!? Take Care, Jay