This article is a follow-up to this article which was a follow-up to this original article.

In a nutshell:

*The original article detailed an example trade that was designed to make a lot of money (theoretically) if gold rallied, and to not lose a lot of money if gold fell (the bulk of the risk involved gold remaining unchanged).

*The second article highlighted the fact that the moment the article was written was a terrible time to get bullish on gold (that was the bad news). The good news is that the trade suffered a miniscule loss even though the timing was essentially 100% wrong (hence the name “Winning While Losing”, i.e., despite what would have been a nightmare scenario if a trader had “bet the ranch” on gold, the result was what was essentially a meaningless loss).

*This article is going to try to turn a sow’s ear into silk by adjusting the initial trade.

The Original Position

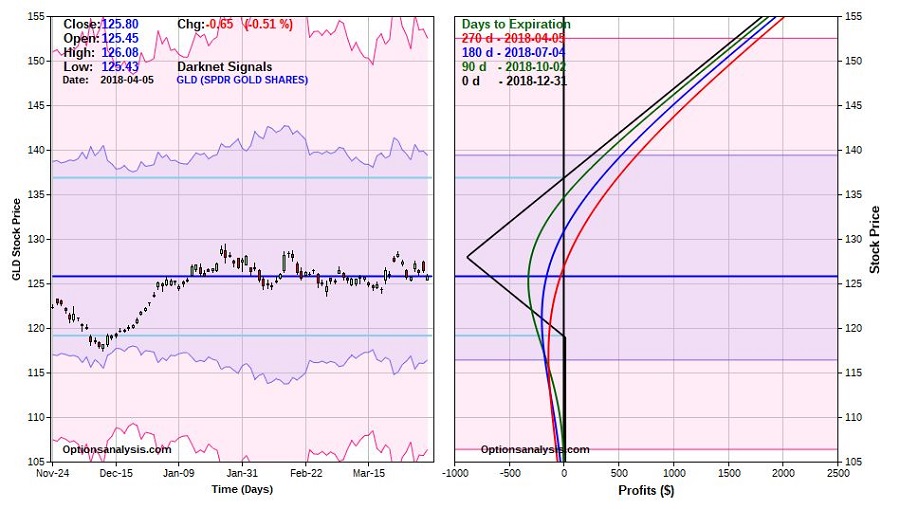

The original (albeit hypothetical) position was entered on April 5th as follows:

*Sell 1 GLD Dec31 119 call @ $10.60

*Buy 2 GLD Dec 31 128 calls @ $5.23

The and the original risk curves appear in Figures 1 and 2.

Figure 1 – Original GLD backspread (Courtesy www.OptionsAnalysis.com)

Figure 1 – Original GLD backspread (Courtesy www.OptionsAnalysis.com)

Figure 2 – Original GLD backspread risk curves (Courtesy www.OptionsAnalysis.com)

Figure 2 – Original GLD backspread risk curves (Courtesy www.OptionsAnalysis.com)

This strategy is referred to as a backspread:

*As you can see in Figure 2 the objective was for gold to go up a lot and for the trade to make a lot of money.

*On the other hand, if gold fell apart the loss would essentially get smaller and smaller the further gold fell.

*The risk occurred if gold remain relatively unchanged.

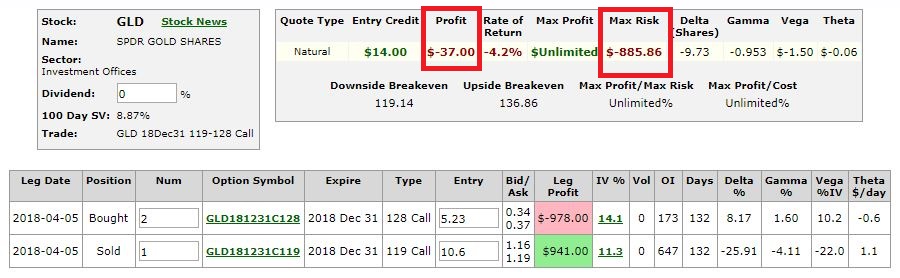

The current status of this position appears in Figures 3 and 4.

Figure 3 – Current status of GLD backspread (Courtesy www.OptionsAnalysis.com)

Figure 3 – Current status of GLD backspread (Courtesy www.OptionsAnalysis.com)

Figure 4 – Current GLD backspread risk curves (Courtesy www.OptionsAnalysis.com)

Figure 4 – Current GLD backspread risk curves (Courtesy www.OptionsAnalysis.com)

Since April 5 GLD has declined from $125.80 to $112.76, a loss of roughly 10%.

The trade as it stands right now has an open loss of just -$37.

The problem now is that GLD must rally a very, very long way for this trade to show any upside gain (and must pass through the “danger zone” where time decay really starts to hurt the position).

So, the choices at this point are:

Choice #1) Do nothing

Choice #2) Exit the trade and call it a day

Choice #3) Adjusting the Position

Choice 1 doesn’t make much sense. Choice 2 makes a lot of sense (but it isn’t nearly as interesting as Choice #3).

Figure 5 displays the annual seasonal trend for Gold. As you can see if seasonality is going to exert itself this time around it is sort of a “now or never” (or more accurately, “soon or next year”) proposition. Figure 5 – Annual Seasonal Trend for Gold (Courtesy Sentimentrader.com)

Figure 5 – Annual Seasonal Trend for Gold (Courtesy Sentimentrader.com)

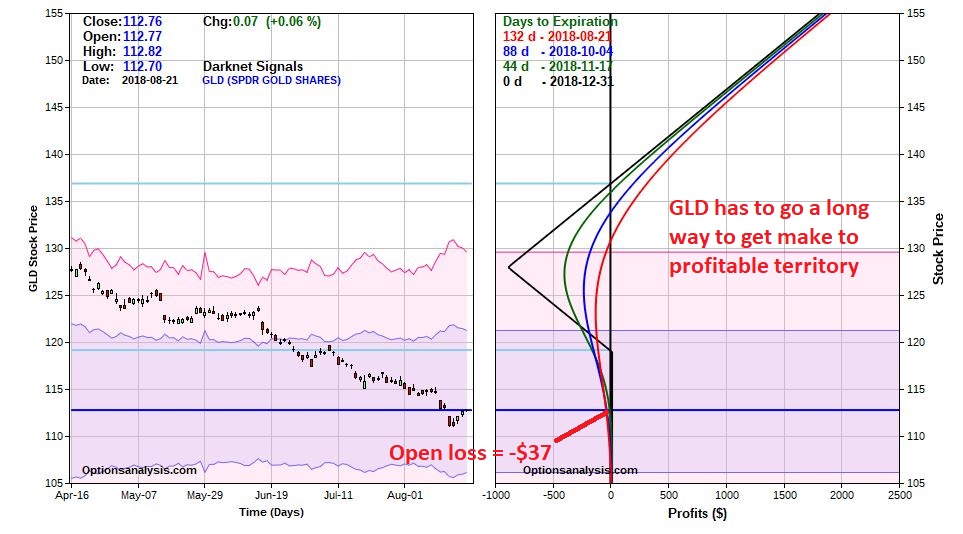

Likewise, as you can see in Figure 6, trader sentiment towards gold is extremely negative – i.e., a potential contrarian bullish sign. Figure 6 – Gold bullish sentiment (Courtesy Sentimentrader.com)

Figure 6 – Gold bullish sentiment (Courtesy Sentimentrader.com)

So, let’s assume that based on seasonality and sentiment (and perhaps some good old-fashioned stubbornness) we want to take “one more shot” at a bounce in gold. Once again, instead of “betting the ranch” we will make a simple adjustment to the original trade that will:

*Reduce overall downside dollar risk

*Give us a better chance of making money if gold does actually rally

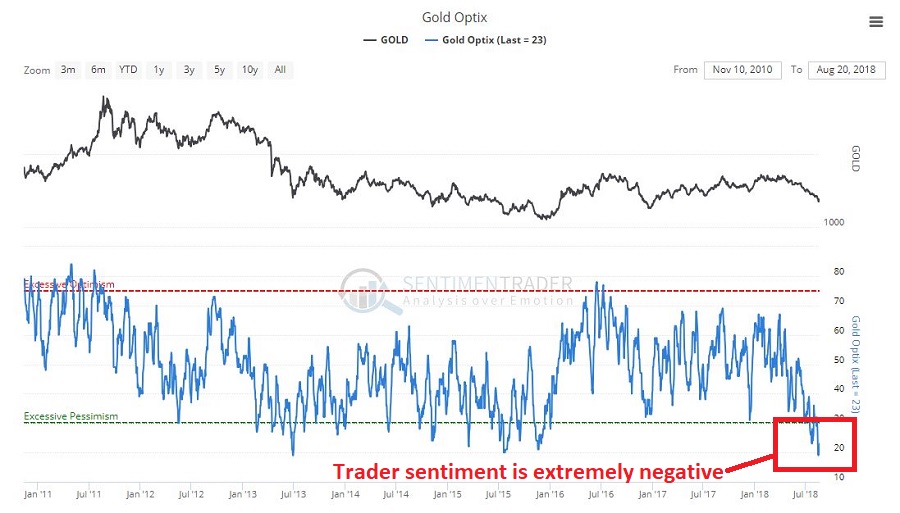

This adjustment involves:

*Buying 2 GLD Dec31 119 call @ $1.19

*Selling 2 GLD Dec31 128 calls @ $0.34

In a nutshell, we are:

*Closing out our long position in the far-out-of-the-money 128 calls, and;

*Reversing to a long position in the 119 calls

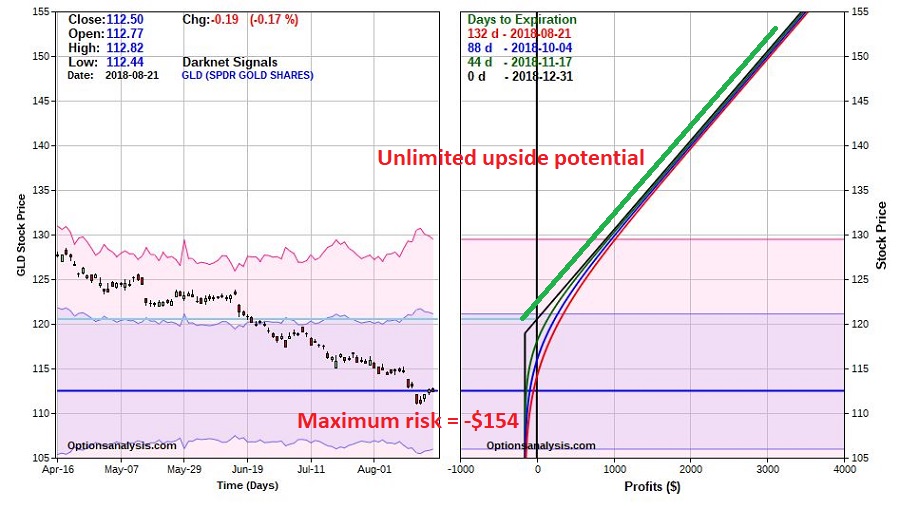

The new position appears in Figure 7 and 8

Figure 7 – Adjusted GLD trade (Courtesy www.OptionsAnalysis.com)

Figure 7 – Adjusted GLD trade (Courtesy www.OptionsAnalysis.com)

Figure 8 – Adjusted GLD risk curves (Courtesy www.OptionsAnalysis.com)

Figure 8 – Adjusted GLD risk curves (Courtesy www.OptionsAnalysis.com)

As you can see:

*This trade is still something of a “long shot bet” on a sharp rally in gold

*The maximum $ risk on this position is now just $-154

The bottom line is pretty simple: either gold finally musters some sort of advance between now and the end of the year, or we lose $154.

Summary

The things to keep in mind about options are:

*There is no one best strategy

*Each strategy offers tradeoffs (the backspread can make a lot if you are right and only lose a little if you are dead wrong – but can cost you if nothing at all happens)

*Positions can – and often should – be adjusted to improve the reward-to-risk profile and/or to improve your chances of generating a positive result.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.