For the record, I am not sure if what I am about to discuss is really a “thing”, but it certainly caught my eye.

First the “Topical” Topic

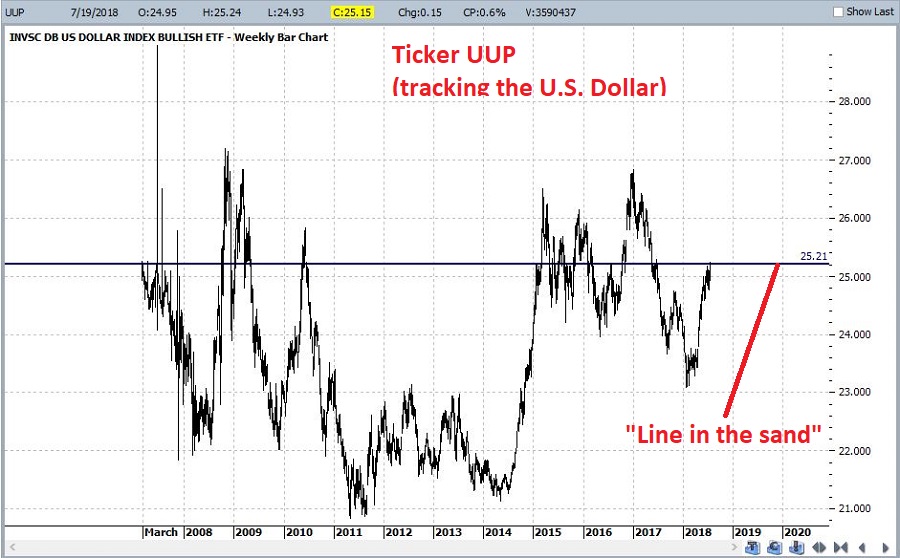

Figure 1 displays a monthly bar chart of ticker UUP – an ETF that tracks the U.S. Dollar. As you can see I have drawn a key “line in the sand” level at $25.21 a share. Figure 1 – Ticker UUP (Courtesy ProfitSource by HUBB)

Figure 1 – Ticker UUP (Courtesy ProfitSource by HUBB)

Simple interpretation would go something like this:

*Above $25.21 = (potentially) bullish

*Below $25.21 = bearish

For the record, UUP hit this key level and fell back just yesterday. But none of this is really the point of this article.

The Party All Night/Sleep All Day Anomaly

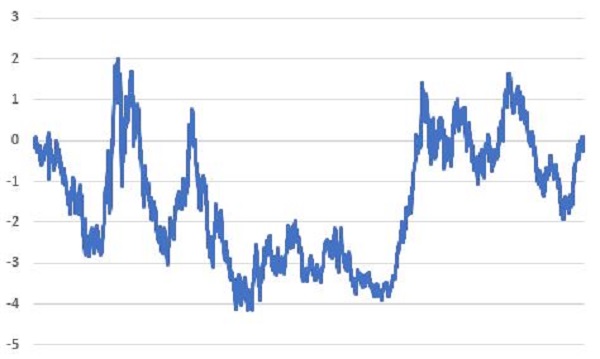

Figure 2 displays the total gain/loss in terms of $/per share for UUP since inception in February 2007. Figure 2 – Total cumulative points gained/lost by buying and holding ticker UUP since inception 2/20/07

Figure 2 – Total cumulative points gained/lost by buying and holding ticker UUP since inception 2/20/07

As you can see, the total net “gain” for UUP over 11+ years is +$0.08. A lot of up, a lot of down, a few trends here and there and in the end, a whole lot of nothing.

Now here comes the “weird” part. Let’s look at two different periods.

A = Today’s open – yesterday’s close (i.e., the Party All Night Period, or PANP for short)

B = Today’s close – today’s open (i.e., the Sleep All Day Period, or SADP for short)

C = The running total of A

D = The running total of B

*A is essentially the “overnight” period

*B is essentially the “intraday” period

*The orange in Figure 3 displays Variable C, i.e., the running total of points gained/(lost) overnight

*The blue line in Figure 3 is the same blue line that appears in Figure 2 showing the cumulative gain/loss achieved by buying and holding UUP

*The grey line in Figure 3 displays Variable D, i.e., the running total of points gained/lost during the actual trading day Figure 3 – Cumulative points +/- Overnight (Orange) versus Buy-and-Hold (Blue) and Intraday (Grey); 2/20/07-7/19/2018

Figure 3 – Cumulative points +/- Overnight (Orange) versus Buy-and-Hold (Blue) and Intraday (Grey); 2/20/07-7/19/2018

Interestingly:

*The “Party All Night Period” (PANP) gained +17.38 points

*The Buy-and-Hold approach gained +0.08

*The “Sleep All Day Period” (SADP) lost -17.30 points

In other words, all the gain occurred overnight, and all the loss occurred during the trading day.

Other figures based on looking at 12-month rolling returns:

*The PANP showed a gain during 80% of all 12-month periods

*The SADP showed a gain during 12% of all 12-month periods

*The PANP outperformed the SADP 88% of all 12-month periods

Summary

Is there a way to actually use this information in trading? I leave that up to the individual trader to determine.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.