Market “legend” makes reference to “The Summer Rally”. There is also a lot of talk about the “Summer Doldrums” historically. Any truth to any of this? As it turns out, “Yes” and “Yes”.

The Test

We will look solely at the summer months of June, July and August. We will further separate those months into two periods:

*The Summer Rally Period: includes the last 3 trading days of June and the first 9 trading days of July

*All Other Days: Which simply include all other trading days during June, July and August*

(*for the record, “All Other Days” includes all the trading days in June prior to the last 3 trading days, all the trading days after the first 9 trading days of the month, plus all trading days in August)

For our test we will use S&P 500 daily price data starting in 1942.

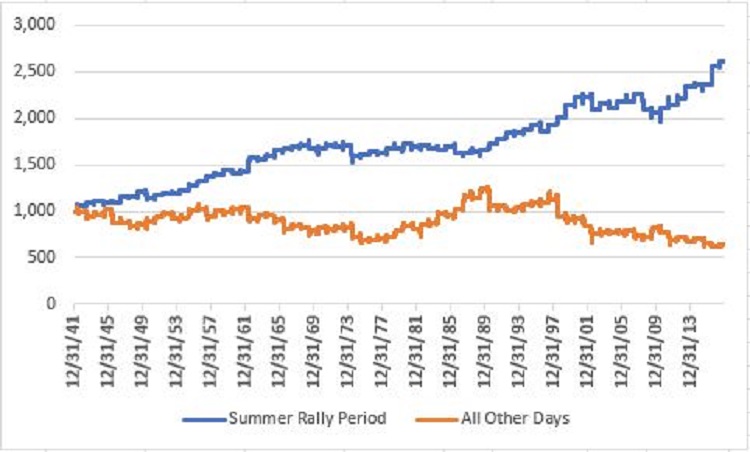

Figure 1 the blue line displays the growth of $1,000 invested ONLY during the 12 day Summer Rally Period every year versus the growth of $1,000 invested during “all other days” (yellow line) during June, July and August every year. Figure 1 – Growth of $1,000 invested in the S&P 500 Index during the Summer Rally Period (blue) versus All Other Summer Days (orange); 1942-2017

Figure 1 – Growth of $1,000 invested in the S&P 500 Index during the Summer Rally Period (blue) versus All Other Summer Days (orange); 1942-2017

Figure 2 displays the fairly stark differences in performance during these two periods.

| Measure | Summer Rally Period | All Other Summer Days |

| Cumulative % +(-) | +160% | (-37%) |

| Average % +(-) | +1.31% | (-0.40%) |

| Worst %- | (-7.1%) | (-15.8%) |

| # Times UP | 55 | 40 |

| # Times DOWN | 21 | 36 |

| % Time UP | 72.4% | 52.6% |

| % Time DOWN | 27.6% | 47.4% |

Figure 2 – Summer Rally Days versus All Other Summer Days; 1942-2017

Summary

This year’s Summer Rally Period extends from the close on 6/26 through the close on 7/13.

Two words of caution:

*No one should mistakenly assume that the stock market is “sure to rally.” With a 72.4% winning percentage, the “Summer Rally” is clearly never a “sure thing”. But it is also a lot better of a bet than the “All Other Days” period which have been up 52.6% of the time and have netted a cumulative loss of -37% over the past 76 years.

*”The Summer Rally” Period has seen the S&P 500 Index generate a gain in each of the last 8 years, so an “off year” is quite possible.

Still, the bottom like is the we could sure use a “Summer Rally” (or any kind of a rally for that matter) right about now.

For the “numbers people”, the year-by-year S&P 500 Index summer results appear in Figure 3.

| Year | All of June/July/August | Summer Rally Period | All Other Days |

| 1942 | 5.8 | 6.6 | (0.7) |

| 1943 | (2.6) | 2.0 | (4.4) |

| 1944 | 3.8 | 1.9 | 1.9 |

| 1945 | 3.3 | (2.0) | 5.4 |

| 1946 | (13.2) | 0.7 | (13.8) |

| 1947 | 6.0 | 6.0 | 0.0 |

| 1948 | (4.3) | (0.2) | (4.1) |

| 1949 | 7.3 | 4.7 | 2.4 |

| 1950 | (1.9) | (5.8) | 4.1 |

| 1951 | 8.2 | 3.2 | 4.8 |

| 1952 | 4.9 | 1.5 | 3.4 |

| 1953 | (5.0) | (0.1) | (4.9) |

| 1954 | 2.2 | 3.0 | (0.8) |

| 1955 | 13.9 | 3.1 | 10.5 |

| 1956 | 5.1 | 4.3 | 0.8 |

| 1957 | (4.7) | 4.1 | (8.4) |

| 1958 | 8.3 | 1.1 | 7.1 |

| 1959 | 1.6 | 3.2 | (1.5) |

| 1960 | 2.0 | (2.1) | 4.2 |

| 1961 | 2.3 | 1.3 | 1.0 |

| 1962 | (0.9) | 10.5 | (10.3) |

| 1963 | 2.4 | (0.6) | 3.0 |

| 1964 | 1.8 | 2.3 | (0.5) |

| 1965 | (1.4) | 3.4 | (4.6) |

| 1966 | (10.5) | 0.9 | (11.2) |

| 1967 | 5.1 | 1.6 | 3.5 |

| 1968 | 0.2 | 1.3 | (1.1) |

| 1969 | (7.7) | (2.5) | (5.3) |

| 1970 | 6.5 | 0.5 | 5.9 |

| 1971 | (0.6) | 1.3 | (1.8) |

| 1972 | 1.4 | (0.5) | 2.0 |

| 1973 | (0.7) | 0.8 | (1.4) |

| 1974 | (17.3) | (6.6) | (11.5) |

| 1975 | (4.7) | 0.6 | (5.3) |

| 1976 | 2.7 | 2.2 | 0.6 |

| 1977 | 0.7 | (0.8) | 1.5 |

| 1978 | 6.2 | 2.7 | 3.4 |

| 1979 | 10.3 | 0.6 | 9.6 |

| 1980 | 10.0 | 2.8 | 7.0 |

| 1981 | (7.4) | (2.4) | (5.1) |

| 1982 | 6.8 | 1.2 | 5.6 |

| 1983 | 1.2 | (1.5) | 2.7 |

| 1984 | 10.7 | (1.2) | 12.1 |

| 1985 | (0.5) | 1.9 | (2.3) |

| 1986 | 2.3 | (4.3) | 6.9 |

| 1987 | 13.7 | 0.6 | 13.1 |

| 1988 | (0.2) | 0.4 | (0.7) |

| 1989 | 9.6 | 1.0 | 8.5 |

| 1990 | (10.7) | 4.3 | (14.4) |

| 1991 | 1.4 | 2.6 | (1.1) |

| 1992 | (0.3) | 3.6 | (3.8) |

| 1993 | 3.0 | 0.6 | 2.4 |

| 1994 | 4.2 | 1.4 | 2.8 |

| 1995 | 5.3 | 3.2 | 2.1 |

| 1996 | (2.6) | (3.3) | 0.8 |

| 1997 | 6.0 | 3.3 | 2.6 |

| 1998 | (12.2) | 4.3 | (15.8) |

| 1999 | 1.4 | 6.3 | (4.6) |

| 2000 | 6.8 | 4.1 | 2.6 |

| 2001 | (9.7) | (0.1) | (9.7) |

| 2002 | (14.2) | (5.6) | (9.1) |

| 2003 | 4.6 | 2.9 | 1.6 |

| 2004 | (1.5) | (2.0) | 0.6 |

| 2005 | 2.4 | 3.0 | (0.6) |

| 2006 | 2.7 | (0.2) | 2.9 |

| 2007 | (3.7) | 4.0 | (7.4) |

| 2008 | (8.4) | (7.1) | (1.4) |

| 2009 | 11.0 | (1.6) | 12.8 |

| 2010 | (3.7) | 1.7 | (5.3) |

| 2011 | (9.4) | 2.2 | (11.4) |

| 2012 | 7.3 | 2.8 | 4.4 |

| 2013 | 0.1 | 5.8 | (5.4) |

| 2014 | 4.1 | 0.9 | 3.2 |

| 2015 | (6.4) | 0.3 | (6.7) |

| 2016 | 3.5 | 8.2 | (4.3) |

| 2017 | 2.5 | 1.6 | 0.8 |

| Average %+(-) | 0.9 | 1.3 | (0.4) |

| Worst %- | (17.3) | (7.1) | (15.8) |

| # Times UP | 47 | 55 | 40 |

| # Times DOWN | 29 | 21 | 36 |

| % Times UP | 61.8 | 72.4 | 52.6 |

| % Times DOWN | 38.2 | 27.6 | 47.4 |

Figure 3 – Year-by-Year

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.9