Good news! Silver is above its price level of a year ago AND it is December! OK, maybe that is a bit too succinct. Perhaps a little more detail is in order.

Silver had a pretty terrific run from the March 2020 low to the July 2020 high, with silver futures rallying from 11.26 to 29.92 (to put it in more stark terms, the $ value of a silver futures contract increased from $56,300 to $149,600). But in recent weeks the “less shiny” metal has experienced enough of a pullback that a lot of traders are starting to turn away and refocusing on the soaring stock market.

While I claim no ability to “predict” the future price of silver, I have noticed that a couple of trends are presently suggesting that right now may be a good time NOT to give up on the stuff.

Two Factors Combined

For our purposes we will combine two factors:

*Factor #1: The change in the price of silver over the previous year

*Factor #2: The current month of the year

From this we can create “Jay’s Silver Model” (such as it is) as follows:

*If silver is above its price of 252 trading days ago then add +1 to the Model

*If the current month is January, February, July, August, November or December then add +1 to the model

And there you have it. For any given trading day, the Model will read 0, +1 or +2.

From here we will accumulate the daily $ +(-) for a silver futures contract (each $1 movement in the price of a silver futures contract is worth $5,000) based on the daily reading for Jay’s Silver Model. The first date of the test is July 20, 1971.

Does this matter? Well consider the following:

When Model = +2: Cumulative silver $ +(-) = +$273,205

When Model = +1: Cumulative silver $ +(-) = (-$57,700)

When Model = 0: Cumulative silver $ +(-) = (-$110,095)

In other words:

*While the Model read +2, silver gained +$273,205

*While the Model was less than +2, silver lost (-$167,865)

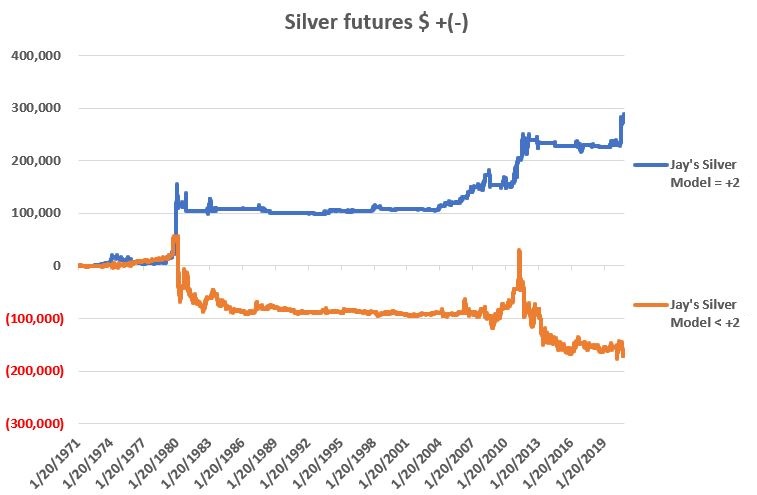

Figure 1 displays the cumulative results.

Figure 1 – Cumulative $ +(-) for silver futures is Jay’s Silver Model = +2 (blue) or Jay’s Silver Model < 2 (red); 1971-2020

The bad new “things” to note from Figure 1 are:

*Silver can spend A LOT of time going nowhere – even if the Model = +2

*There can ALWAYS be countertrend bullish moves – even if the Model < +2

Still, the stark difference between the two lines suggests that there might be some useful information – at the very least on a “wight of the evidence” basis – conveyed for anyone looking to trade silver.

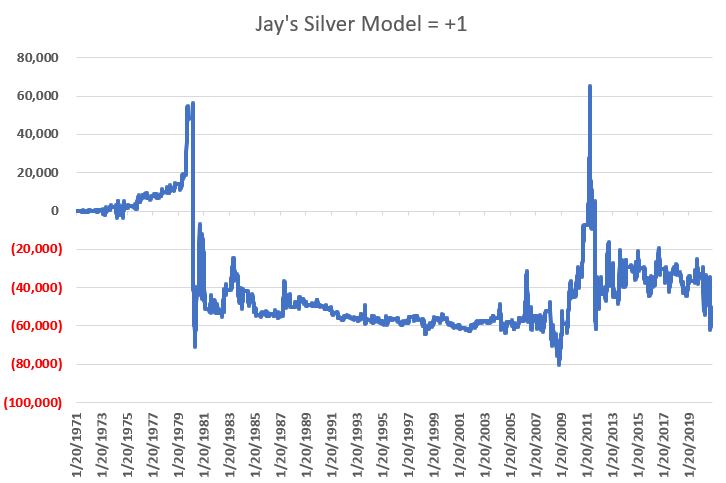

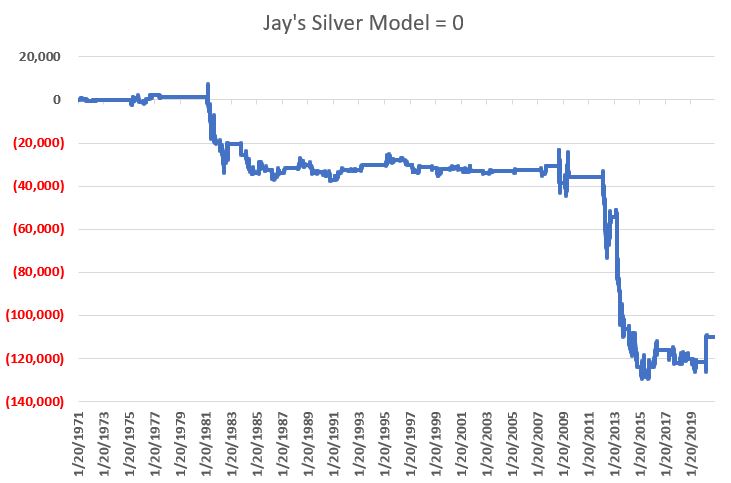

One other “interesting note” appears in Figures 2 and 3. Figure 2 displays the cumulative results for silver futures when the Model reads +1 and Figure 3 when the Model reads 0.

Figure 2 – Cumulative $ +(-) for silver futures is Jay’s Silver Model = +1; 1971-2020

Figure 3 – Cumulative $ +(-) for silver futures is Jay’s Silver Model = 0; 1971-2020

Note in Figure 2 that there were several massive countertrend rallies in silver while the Model read +1. However, in Figure 3 we see that very little good ever happens for silver when the Model reads 0.

To reiterate, Figure 3 displays the $ gain/loss from holding a long position in silver futures when:

A) silver is below its price level of 1 year ago (for the record I use 252 trading days with a 1-day lag) AND

B) The current month is NOT Jan., Feb., Jul., Aug., Nov. or Dec

Figure 4 displays the cumulative (hypothetical) gain generated by:

*Holding a long position in silver futures when the Model = +2

*Holding a flat position in silver futures when the Model = +1

*Holding a short position in silver futures when the Model = 0

Also displayed is the cumulative gain from buying and holding a silver futures contract.

Figure 4 – Cumulative $ +(-) for silver futures holding a long position if Jay’s Silver Model = +2 and a short position if Jay’s Silver Model = 0; 1971-2020

The Current State of Affairs

*Silver is well above its price of one year ago (and that will remain the case as long as silver holds above roughly $18). So, Part 1 of the Model is positive.

*In addition, the second part of the model will remain bullish through the end of February 2021.

The bottom line is that the Model is pretty much “stuck on +2” for another 3 months. Does this “guarantee” that silver is certain to rise in the months ahead? Not at all. The Model was bullish all of November and during that time silver peaked and declined by 15% from that peak. So, there is nothing “magical” going on just because this silly little “Model” reads +2.

But history suggests that if you are going to play silver, it might be most prudent to play it from the long side, particularly as long as the recent support level of $21.81 (see Figure 5) holds.

Figure 5 – Silver w/ recent support (Courtesy ProfitSource by HUBB)

See also Jay Kaeppel Interview in July 2020 issue of Technical Analysis of Stocks and Commodities magazine

See also Jay’s “A Strategy You Probably Haven’t Considered” Video

See also Video – The Long-Term…Now More Important Than Ever

Jay Kaeppel

Disclaimer: The information, opinions and ideas expressed herein are for informational and educational purposes only and are based on research conducted and presented solely by the author. The information presented represents the views of the author only and does not constitute a complete description of any investment service. In addition, nothing presented herein should be construed as investment advice, as an advertisement or offering of investment advisory services, or as an offer to sell or a solicitation to buy any security. The data presented herein were obtained from various third-party sources. While the data is believed to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. International investments are subject to additional risks such as currency fluctuations, political instability and the potential for illiquid markets. Past performance is no guarantee of future results. There is risk of loss in all trading. Back tested performance does not represent actual performance and should not be interpreted as an indication of such performance. Also, back tested performance results have certain inherent limitations and differs from actual performance because it is achieved with the benefit of hindsight.