This is a follow up to this previous article. It’s never a good day to be sick, but as it turns out there are days that are better than others for seeking health care, well, health care stocks at least.

The “Strategy”

Buy and hold ticker HCPIX (Profunds Healthcare fund – which tracks the Dow Jones U.S. Health Care Index leveraged 1.5-to-1) on the following days:

*Trading days #9, 10, 11 and 12 each month

*The last 4 trading days of the month and the first 2 trading days of the next month

Continue to make these trades each and every month until, um, well, until you no longer have a need for health care, if you get my drift.

The Results

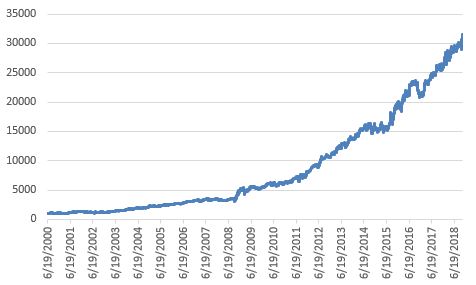

Figure 1 displays the growth of $1,000 invested in HCPIX using the Strategy rules listed above.

Figure 1 – Growth of $1,000 invested in HCPIX using Jay’s Strategy; 6/19/00-11/2/18

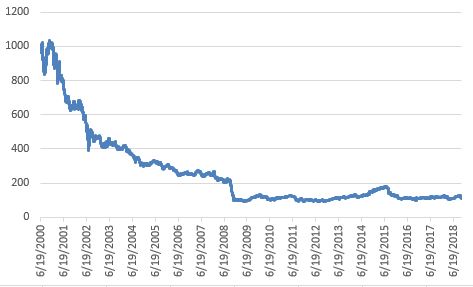

Figure 2 displays the growth of $1,000 invested in HCPIX during all other trading days.

Figure 2 – Growth of $1,000 invested in HCPIX during all other trading days; 6/19/00-11/2/18

The results in Figure 2 are enough to make you sick. Fortunately, the cure appears in Figure 1.

For the record, from 6/19/2000 through 11/2/2018:

*$1,000 invested during Good Days grew to $31,197 (+3,020%)

*$1,000 invested during Bad Days shrank to $112 (-89%)

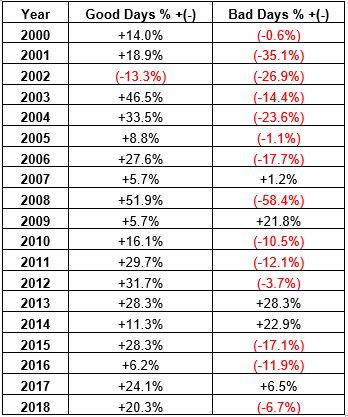

Figure 3 displays year-by-year result through 11/2/2018.

Figure 3 – Year-by-Year results; 6/19/00-11/2/18

*The Good Days gained an annual average of +20.8%

*The Bad Days lost an annual average of -8.4%

Summary

I hope this helps you feel better.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.

OK, Jay, numbers are numbers, but I gotta ask– what’s the logic behind this? How do you explain the phenomenon?

Thanks.

Jim

James, the end/beginning of the month and the middle of the month is where the money is made in the stock market. Health care stocks – especially when leveraged – do a bit better than most indexes/sectors. The method presented is volatile, risky and a pain in the rear to follow. But the numbers are what they are… Take Care, Jay

So speaking of a pain in the rear to follow, Jay, can we consider 2 earlier methods, please? Your “Don’t have a Bad Day” (8/10/2018) calls for being out of the market 11-16 thru 11-26 for 6 days. And your “Happy Holidays Revisited” (1/16) calls for being in the market for 6 days, during which time coming up this month has them overlap on 4 of the 6. What happens then? Thanks.

James Heath

Good question. In reality, I tend to look at these “methods” as standalone methods. The Health Care idea stands on its on using a health care fund or ETF. The other two you mentioned are based on decades of broad index data. Haven’t ever really tried to “put them altogether”, so can’t accurately answer your question. Jay

Jay,

Would you buy on day #8 and the 5th last day of the month in order to be in on day #9 and the 4th last day? Or, wait until #9 and the 4th last day?

Thanks.

The method used was “buy at the close on Day #8 and sell at the close on the 12th day”. Also, buy at the close on 5th to last day. Hope that helps. Jay