There is a lot of speculation about the future course of small-cap stocks. Of late, small-cap stocks have been lagging large-cap stocks and the broad market overall.

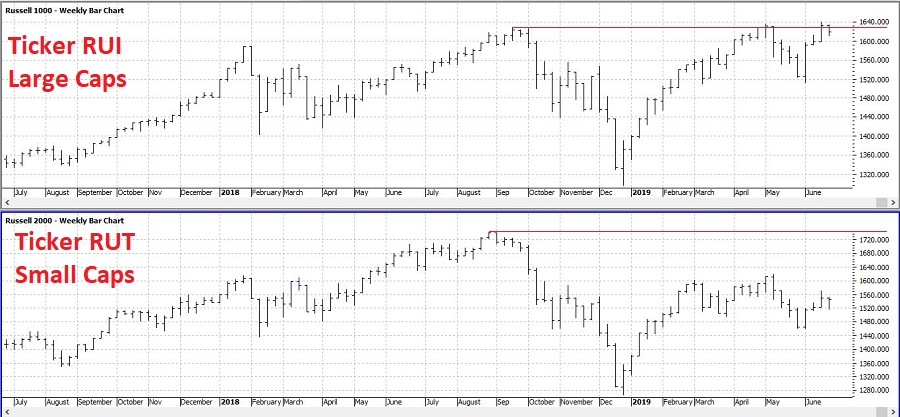

As you can see in Figure 1 below, while large-cap stocks (Top clip: Russell 1000, ticker RUI) recently touched a new all-time high, small-cap stocks (Bottom clip: Russell 2000, ticker RUT) have come nowhere close. In fact, small-cap stocks have only retraced about 50% of the Aug-Dec 2018 decline.

Figure 1 – Large-cap stocks (RUI, top clip) versus small-cap stocks (RUT, bottom clip); 1989-2019 (Courtesy ProfitSource by HUBB)

Figure 1 – Large-cap stocks (RUI, top clip) versus small-cap stocks (RUT, bottom clip); 1989-2019 (Courtesy ProfitSource by HUBB)

This of course leads to a lot of prognosticating about “what’s next” for small-cap stocks. One school of thought thinks small-cap stocks offer the best bargain right now, while the other school of thought claims that the weakness in small-caps is a sign of something worse for the overall market.

My “forecast”? I don’t really claim to have one. But I do follow a bit of market history. And while history is by no means always an accurate guide, it can give clues. These clues can be useful since a big part of investing success is putting the odds on your side as much as possible.

For what it is worth, history presently suggests that the odds may not favor an emphasis on small-cap stocks at the moment.

SSSSS

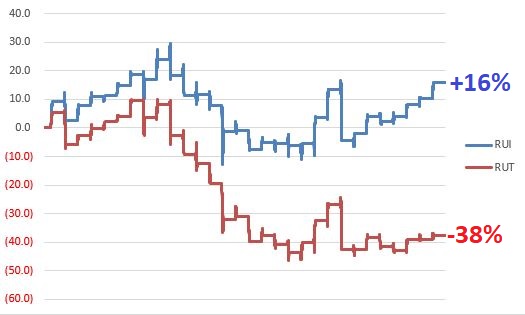

SSSSS is a little known (primarily because I just made it up) acronym for Smallcaps Seasonally Suck in Summer Syndrome. To wit: Figure 2 displays the cumulative % price gain for RUI (blue line) and RUT (red line) ONLY from the end of June through the close of the 6th trading day of August every year since 1989

Figure 2 – Cumulative price % +(-) for Large-cap (blue) and Small-Cap (red) indexes from end of June through August Trading Day #6, 1989-2018

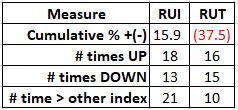

Figure 3 contains a few key pieces of info.

Figure 3 – Relevant Data; End of June through August Trading Day #6; 1989-2018

One thing that is important to note is that the implication is NOT that small-cap stocks are doomed to decline between now and early August. For the record, RUT has showed a gain 52% of the time and a loss only 48% of the time during this period. However, the average gain was +7.4% while the average loss was -9.5%.

The other key point to note is that large-caps have outperformed small-caps 68% of the time during (21 out of 31 years) this period since 1989.

Summary

The reality is that none of the above information should be construed to imply that large-cap stocks will do well and/or better than small-cap stocks and that small-cap stocks will lose between now and early August.

But, if one had to bet based on the historical odds, small-cap enthusiasts might consider containing their enthusiasm for just a bit longer.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.

End of June, correct? Figure 3 says end of July.

Yes, you are correct, it should say end of June.