In this article on 10/30 I highlighted a hypothetical example trade in XLF, based on:

*An expected bounce in the overall market

*Extremely negative sentiment for XLF

*A positive divergence between XLF price action and the 3-day RSI

Guess what, folks…sometimes this stuff actually works!

The example trade was intended as nothing more than a short-term speculation hoping for a “pop” in XLF. Figure 1 displays the current status of the trade (assuming the trader was willing to risk $500 on the trade) as I type.

Figure 1 – XLF Dec 26 call option trade (Courtesy www.OptionsAnalysis.com)

Figure 1 – XLF Dec 26 call option trade (Courtesy www.OptionsAnalysis.com)

The good news is that XLF moved higher yesterday and is up more than 2% today. The trade has already generated more than a 60% profit. The bad news is that everything could change very quickly if XLF turns back down.

So, a trader in this example has 3 basic choices:

1. Let it ride

2. Take a profit

3. Adjust the trade

Here is one thing you need to know and accept if you are going to trade options: There is no “correct” answer among the choices listed above. Each trader must make decisions about how they want to proceed based on their own individual outlook and priorities.

#1. Let it Ride: If you think things are looking good and you want to try riding it further then no action is necessary. Now would be a good time, however, to decide what exactly would cause you to act going forward, i.e., if XLF RSI hits 75, or if XLF price drops back below $26, etc., etc. (here again, there are no “correct” answers).

#2. Take a Profit: As this was intended as a speculative short-term trade hoping for a “pop”, there is nothing wrong with saying “Mission Accomplished” and cashing out. Just remember to avoid the human nature tendency to kick yourself if XLF keeps moving higher. You accomplished your goal – move on without emotion.

#3. Adjust the Trade: There are countless possibilities and again, no “correct” choice. But for the sake of example let me highlight one possibility. This one involves:

*Selling 4 Dec 26 calls @ $1.12

*Selling 2 Dec 27 calls @ $0.59

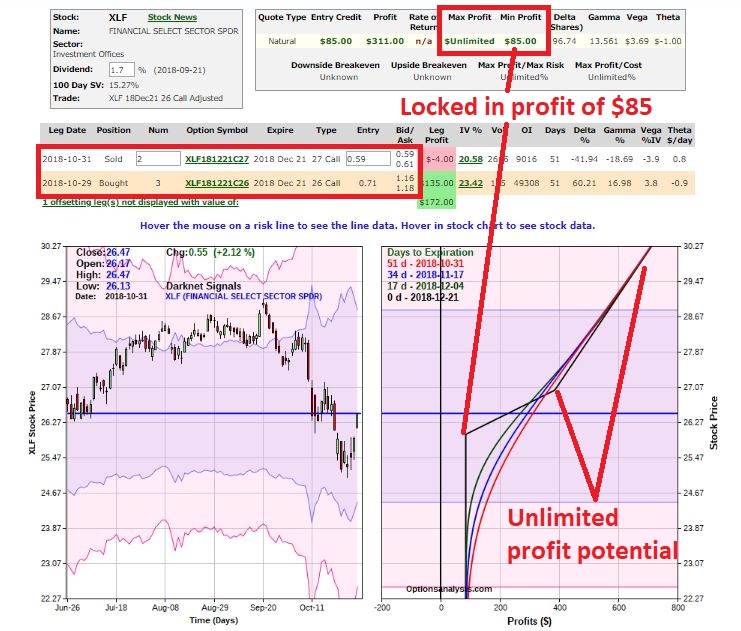

This leaves a trader with 3 long Dec 26 calls and 2 short Dec 27 calls. The sum total of all of this appears in Figure 2.

Figure 2 – Adjusted XLF position (Courtesy www.OptionsAnalysis.com)

Figure 2 – Adjusted XLF position (Courtesy www.OptionsAnalysis.com)

This position has locked in a small profit and still enjoys the potential for unlimited profits if XLF continues to advance (albeit much less profit potential than with the original 7-lot position).

Summary

There are a lot of ways to “play the game”. The key is to:

*Spot opportunity

*Exploit opportunity (without assuming more risk than you can handle)

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.