A strong argument can be made that it’s not “what you buy” but “when you buy it” that matters most. Certainly not every trader would agree with that statement (which is a good thing otherwise we would have no one to trade with). But with this thought in mind, let’s jump ahead and take a brief look into 2021.

2021: By the Calendar

As it fits into the 4-year election cycle 2021 is a “post-election” year. Post-election years have a reputation as being “unfavorable” for the stock market. In reality, they are “about average” for the stock market. If we look at price only performance for the Dow Industrial Average every post-election starting in 1901, we find:

*16 times up, 14 times down – a 53.3% win rate

*Average % gain = +6.8%

Now let’s break the post-election year down a little finer:

*”Favorable” period = March, April, May, July and December

*”Unfavorable” period = All other months

The Test

So let’s look at the cumulative returns one might have achieved if a person (had lived to be a very ripe old age, and);

*Held the Dow ONLY during the “Favorable” months

OR

*Held the Dow ONLY during “all other months”

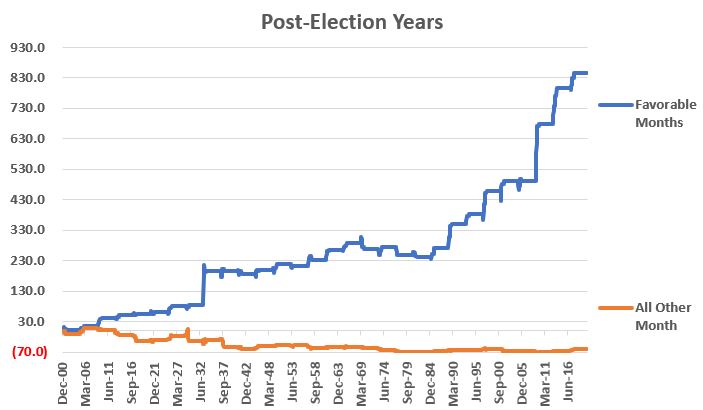

The blue line in Figure 1 displays the cumulative growth achieved ONLY during the “favorable” post-election year months of March, April, May, July and December.

The orange line displays the cumulative growth achieved only during “all other” post-election months.

Figure 1 – Post-Election Years “Favorable Months” cumulative price gain (blue) versus “All Other Months” cumulative price gain (orange); 1901-present

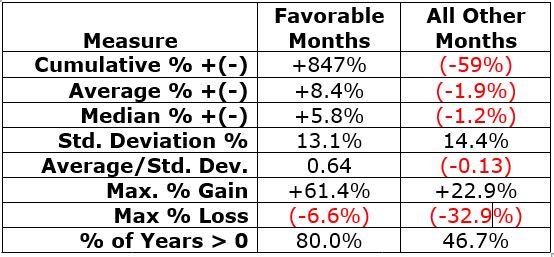

Figure 2 displays the relevant facts and figures.

Figure 2 – Post-Election Years “Favorable Months” versus “All Other Months”; 1901-present

The key things to note:

*The “favorable months” achieved a cumulative return of +847%; the “unfavorable months” achieved a loss of -59%

*The “favorable months” showed an annual gain 80% of the time (versus 53% for buy and hold and 47% for “all other months”)

*The average and median results for “favorable months” were positive, while the average and median results for “all other months” were negative.

*The worst annual loss achieved during “favorable months” only was -6.6%. The worst annual loss for “all other months” was -32.9%

Summary

Post-election years have seen the Dow gain 53% of the time since 1901 for a cumulative price gain of +286%.

However, a trader who held the Dow ONLY during April, May, July and December of each post-election year enjoyed an “Up” post-election year 80% of the time with a cumulative price gain of +640%.

Is this “edge” guaranteed to play out in 2021? Not at all. But it might be worth remembering.

See also Jay Kaeppel Interview in July 2020 issue of Technical Analysis of Stocks and Commodities magazine

See also Jay’s “A Strategy You Probably Haven’t Considered” Video

See also Video – The Long-Term…Now More Important Than Ever

Jay Kaeppel

Disclaimer: The information, opinions and ideas expressed herein are for informational and educational purposes only and are based on research conducted and presented solely by the author. The information presented represents the views of the author only and does not constitute a complete description of any investment service. In addition, nothing presented herein should be construed as investment advice, as an advertisement or offering of investment advisory services, or as an offer to sell or a solicitation to buy any security. The data presented herein were obtained from various third-party sources. While the data is believed to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. International investments are subject to additional risks such as currency fluctuations, political instability and the potential for illiquid markets. Past performance is no guarantee of future results. There is risk of loss in all trading. Back tested performance does not represent actual performance and should not be interpreted as an indication of such performance. Also, back tested performance results have certain inherent limitations and differs from actual performance because it is achieved with the benefit of hindsight.

Very helpful insights Jay. Thank you.