Sometimes “all the pieces fall in place.” Of course – and unfortunately – even then a profit is never guaranteed. That is why the keys to long-term success are:

*Putting the odds in your favor on a regular basis

*Managing risk

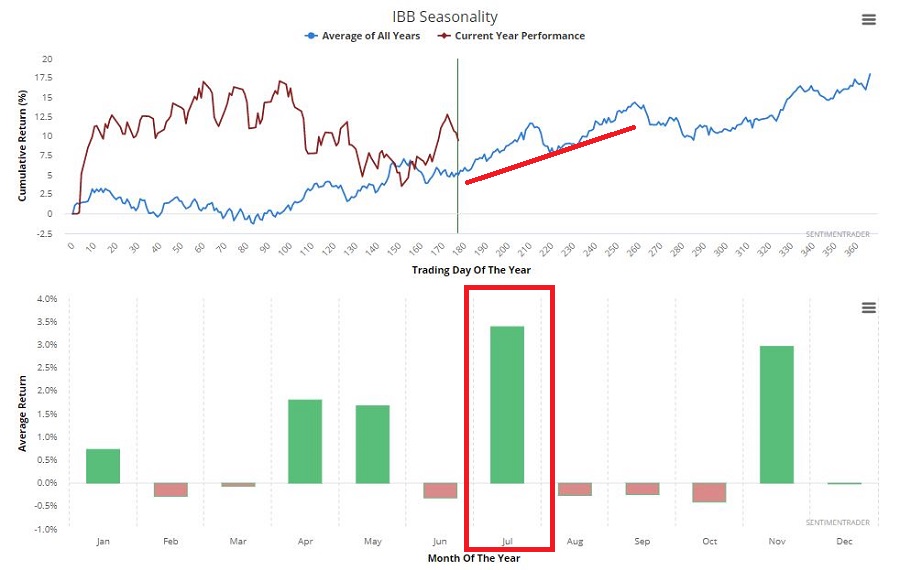

Consider the biotech sector. As you can see in Figure 1, the Elliott Wave count for ticker XBI is bullish. Figure 1 – Biotech seasonality is favorable (Courtesy Sentimentrader.com)

Figure 1 – Biotech seasonality is favorable (Courtesy Sentimentrader.com)

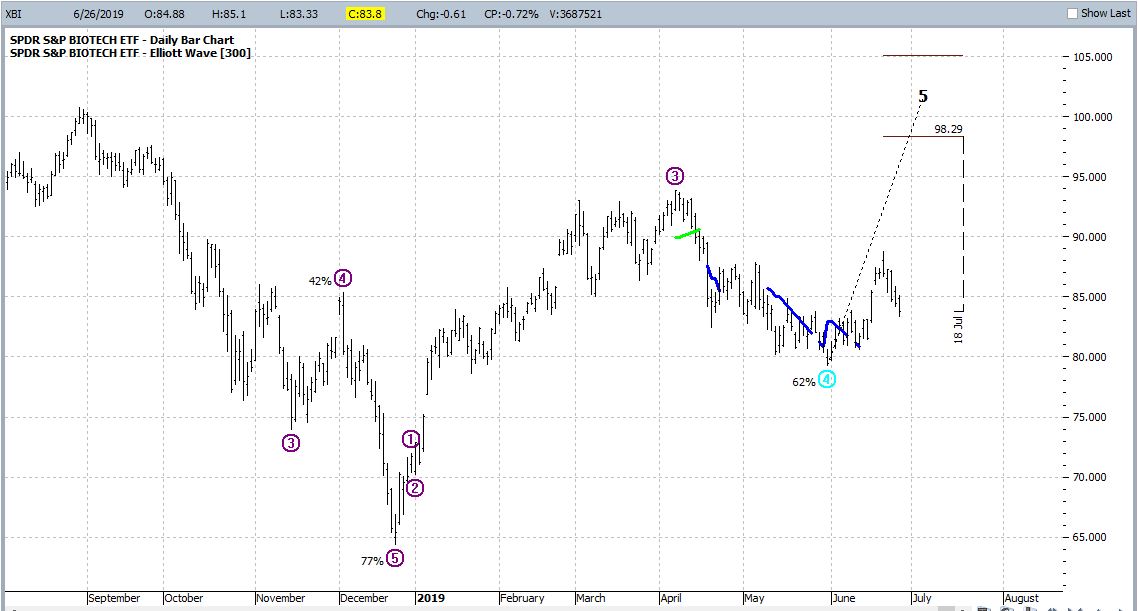

As you can see in Figure 2, right now is the beginning of a seasonally favorable time of year for the biotech sector.  Figure 2 – XBI with bullish Elliott Wave count (Courtesy ProfitSource by HUBB)

Figure 2 – XBI with bullish Elliott Wave count (Courtesy ProfitSource by HUBB)

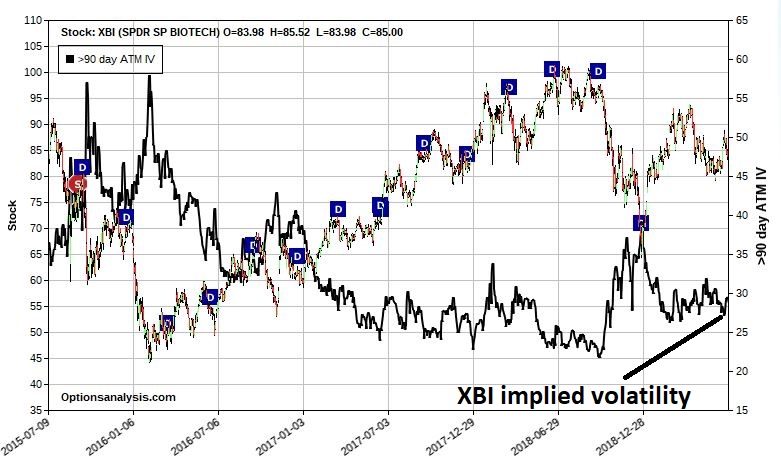

In Figure 3, we see that the implied volatility on options for XBI are neither extremely high nor extremely low. Figure 3 – XBI with implied options volatility (Courtesy www.OptionsAnalysis.com)

Figure 3 – XBI with implied options volatility (Courtesy www.OptionsAnalysis.com)

When we put all of this together, we can make a case for a bullish trade in XBI.

Given the bullish Elliott Wave count, one possibility would be to buy a call option in hopes of maximizing profitability if the ETF does in fact soar to higher ground. However, given, a) that options are not “cheap” (i.e., implied volatility is not extremely low) and, b) that Elliott Wave projections that call for large gains in a short period of time tend to be less reliable than projections that call for decent gains over a longer period of time, we will opt for a different approach.

A Bull Put Spread

What follows is NOT a “recommendation”, only an “example”.

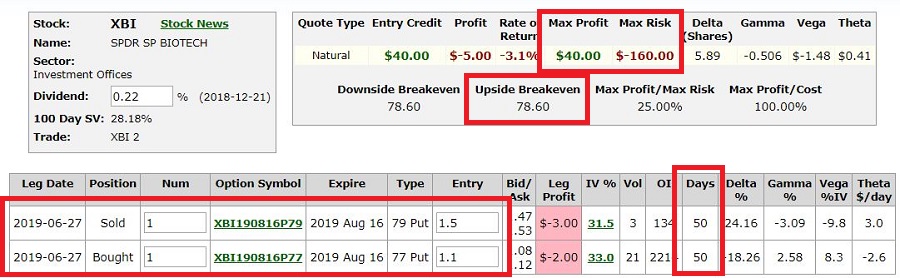

The trade in Figures 4 and 5 is referred to as a “Bull Put Spread” because it is a position that profits from a bullish move (or at least NOT a bearish move by XBI) and uses put options.

The trade involves:

*Selling 1 XBI Aug16 79 put @ $1.50

*Buying 1 XBI Aug 16 77 put @ $1.10

Figure 4 – XBI bull put spread details (Courtesy www.OptionsAnalysis.com)

Figure 4 – XBI bull put spread details (Courtesy www.OptionsAnalysis.com)

Figure 5 – XBI bull put spread risk curves (Courtesy www.OptionsAnalysis.com)

Figure 5 – XBI bull put spread risk curves (Courtesy www.OptionsAnalysis.com)

Note:

*The maximum profit on a 1-lot is $40

*The maximum risk is -$160

*The breakeven price at expiration is $78.60

*XBI is presently trading at $85.04

*The most recent low for XBI was $79.31

In a nutshell, the breakeven price for this trade is below the recent low of $79.31. This means we don’t need to worry about stopping ourselves out if XBI merely comes down and tests support at $79.31. We can set a stop-loss point somewhere near the breakeven price of $78.60 lower.

A trader might consider exiting the trade with a profit, if 80% of the premium is captured prior to expiration (i.e., if the spread can be bought back at $0.08 or less).

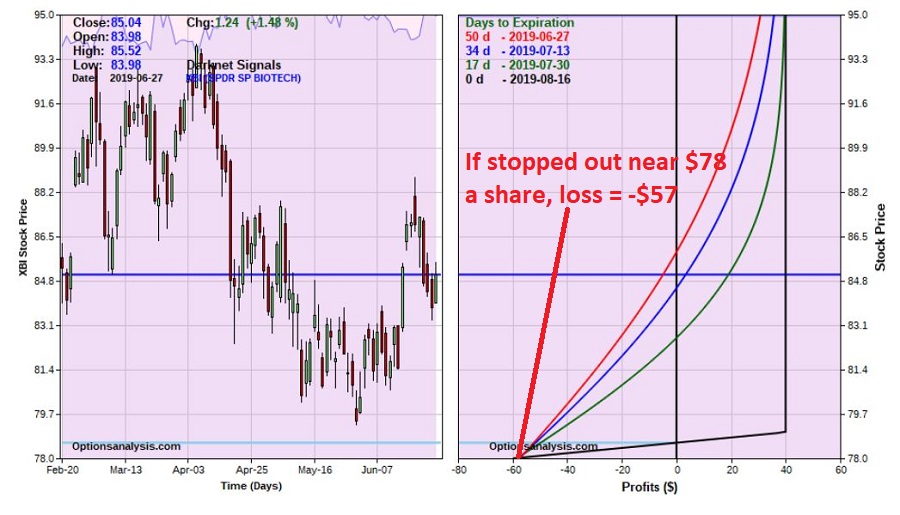

In Figure 6 we zoom in to find that if we place a stop-loss around $78 a share for XBI, the expected loss on our trade would be -$57.

Figure 6 – If XBI declines below support, stop-loss action may be necessary and may be able to limit loss to a reasonable amount (Courtesy www.OptionsAnalysis.com)

Figure 6 – If XBI declines below support, stop-loss action may be necessary and may be able to limit loss to a reasonable amount (Courtesy www.OptionsAnalysis.com)

Summary

As always, I am not “recommending” the trade highlighted here. It is presented simply as an “example” of a situation where all the pieces come together to create a potential trading opportunity. In this example:

*Seasonal trends are favorable

*Price trends (based on Elliott Wave) may be favorable

*An option trade can be entered that may be profitable if XBI does anything besides drop a little over 8% in the next 50 days.

*The position has the “odds in its favor” and we have a plan to manage risk.

The reality is that XBI could fall apart quickly and this trade could turn into a quick loss (and the trader MUST be prepared to act to cut their loss in that event). But under any other circumstance, a profit is a possibility.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.