Anecdotally, I am going to guess that roughly 98% of all articles I read about the housing market are negative regarding the (short-term and long-term) future of housing. Maybe I am extrapolating but it just seems like an easy thing for people to be negative about. And given the housing bubble in 2008 and the re-inflation of housing prices in certain locations maybe they are not wrong.

But for now, the stock market does not seem to care. Since the Christmas Eve low home builder stocks are up roughly 30%. For people who pay attention to “financial news” this probably comes a surprise. For people who pay any attention at all to seasonal trends, it should not

Ticker FSHOX

As a proxy for housing stocks we will use Fidelity Select Construction and Housing sector fund, which began trading in 1986. What we will find is that this sector has a, ahem, large seasonal bias. Let’s keep it short and sweet.

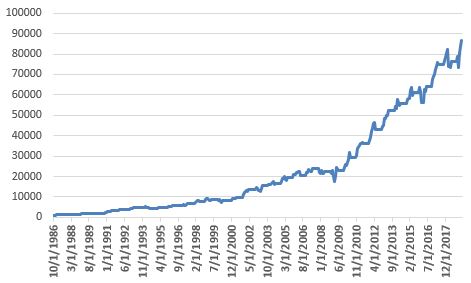

Figure 1 displays the growth of $1,000 invested in FSHOX ONLY during the months of November through April every year starting in 1986.

Figure 1 – Growth of $1,000 invested in FSHOX Nov 1 through Apr 30; 10/31/1986-3/31/2019

For the record, FSHOX gained +8,584% during November through April since 1986.

Figure 2 displays the growth of $1,000 invested in FSHOX ONLY during the months of May through October every year starting in 1987.

Figure 2 – Growth of $1,000 invested in FSHOX May 1 through Oct 31; 10/31/1986-3/31/2019

For the record, FSHOX lost -63% during May through October since 1987.

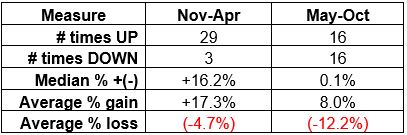

Figure 3 displays the summary for both the favorable and unfavorable seasonal periods.

Figure 3 – Summary of FSHOX performance (10/31/1986-10/31/2018)

The results in Figure 3 do NOT include the latest bullish period that started on 10/31/2018 and will end on 4/30/19. From 10/31/18 through 3/31/19 FSHOX is up roughly +13.6%. Barring an unforeseen collapse, FSHOX will register its 30th “Up” bullish period in the past 33 years (i.e. 91% winners) at the end of April 2019.

The other key thing to note is that while FSHOX has lost a lot of value during the Bearish months of May through October over the years, on a year-by-year basis it is a 50/50 proposition.

Summary

So, is the housing market about to “collapse” – as so many pundits seem to love to predict? It beats me. All I know is that history suggests that the outlook for housing stocks in the next 6 months (starting May 1st) is less favorable than it was 6 months ago.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.