This piece involves a look at crude oil, including a specific “forecast.” However, the purpose of the article is to help traders to focus on making the right trading choice by identifying exactly what it is they want to achieve and their own priorities.

For the record, I am not endorsing (nor disavowing) the price forecast contained in Figure 1 below, nor am I “recommending” a bearish trade in crude oil. The real purpose of this piece is to help teach option traders to understand exactly what they are getting into (and NOT getting into) with certain actions.

Ticker USO

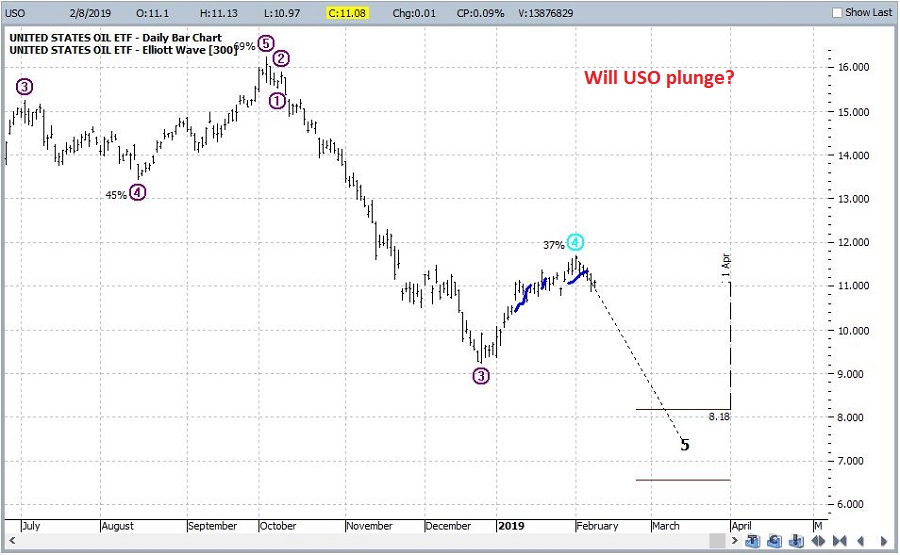

Ticker USO is an ETF that ostensibly tracks the price of crude oil futures. ProfitSource is software that I have used for many years (and yes do recommend). One built-in feature is an Elliott Wave count that can be used on a daily, weekly, monthly, etc. chart. Figure 1 – Ticker USO with ProfitSource Elliott Wave count (Courtesy ProfitSource by HUBB)

Figure 1 – Ticker USO with ProfitSource Elliott Wave count (Courtesy ProfitSource by HUBB)

Two things to note:

1) I am not a true “Elliott Head” (i.e., I don’t qualify as a “true believer” that everything in the universe moves in 5 wave patterns), and,

2) I feel zero confidence in my own personal ability to manually “count the waves.”

That being said, when the ProfitSource daily and weekly EW counts both point to a potential Wave 5 decline, I pay attention because I have seen some nice moves follow often enough to, well, get my attention.

For the record, USO is showing a potential Wave 5 decline on the daily chart that appears in Figure 1 but NOT on the weekly chart. So again, this example is more of a “teaching aide” and not a table-pounding call to action.

Anyway, as you can see in Figure 1, the ProfitSource daily EW count (which for better or worse, is calculated using an objective, built in algorithm) is currently pointing to a significant price decline in the very near term (i.e., a decline to roughly $8.20 down to as low as $6.60 a share sometime between now and the 1st of April).

One last time, let me point out that I am not agreeing nor disagreeing with this forecast. So, let’s move on to “the point”.

What to Do with This Forecast

Granted, the easiest thing to do is to hit Return and go on to the next article. But, let’s assume a trader wants to play the bearish side of crude oil. What to do then?

One choice is to sell short shares of USO. This involves opening a margin account, meeting margin requirements, and assuming (essentially) unlimited risk if USO decides to soar instead of swoon.

So let’s assume two traders are considering buying put options on USO in an effort to profit if USO does indeed tank within the expected timeframe.

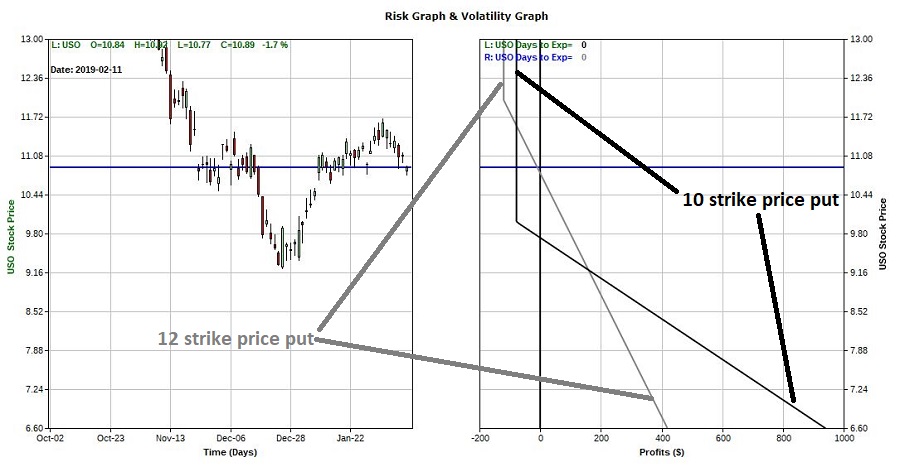

Trader A buys the in-the-money Apr2019 12 strike price put as shown in Figure 2. Figure 2 – Long 1 April 2019 12 strike price put (Courtesy www.OptionsAnalysis.com)

Figure 2 – Long 1 April 2019 12 strike price put (Courtesy www.OptionsAnalysis.com)

As you can see in Figure 2:

*The 1-lot costs $120, the trade has a “delta” of -67 and the breakeven price is $10.80 a share at April expiration

*This is essentially a “(short) stock replacement” approach as below $10.80 a share, the option price will move point for point with the share price. In other words, if USO declines in price by $1.00 per share, the April 19 put will increase in price by $1.00 per option).

Trader B is more aggressive and buys 3 of the out-of-the-money Apr2019 10 strike price put as shown in Figure 3.

Figure 3 – Long 3 April 2019 10 strike price puts (Courtesy www.OptionsAnalysis.com)

Figure 3 – Long 3 April 2019 10 strike price puts (Courtesy www.OptionsAnalysis.com)

As you can see in Figure 3:

*The 3-lot costs $78, the trade has (also) a “delta” of -67 and the breakeven price is $9.74 a share at April expiration

In essence, Trader B is more interested in the return “on” my money and Trader A is more interested in the return “of” my money. The key difference in deciding whether to emulate Trader A or Trader B comes down to this question:

*Is your primary goal to maximize your return if USO falls hard

OR

*Is your primary goal to make some money even if USO only falls a bit?

To understand this tradeoff better, consider Figure 4 which overlays the two trades together on one chart.

Figure 4 – Risk curves at April expiration for April 10 put and April 12 put (Courtesy www.OptionsAnalysis.com)

Figure 4 – Risk curves at April expiration for April 10 put and April 12 put (Courtesy www.OptionsAnalysis.com)

Note the following. Assuming the trade is held until expiration:

If USO closes at $10.00 a share:

*The 12-strike price put will be worth $2.00. Since a 1-lot was bought @ $1.20, Trader A will have a profit of $80 on his $120 investment

*The 10-strike price put will expire worthless and Trader B will experience a loss of $78 on his $78 investment.

If USO closes at the first EW target of (roughly) $8.20 a share:

*The 12-strike price put will be worth $3.80. Trader A will have a profit of $260 on his $120 investment (($3.80 – $1.20) x 100 shares)

*The 10-strike price put be worth $1.80 and Trader B will have a profit of $522 on his $78 investment (($1.80 – $0.26) x 100 shares x 3 options)

If USO closes at the second EW target of (roughly) $6.60 a share:

*The 12-strike price put will be worth $5.40. Trader A will have a profit of $460 on his $120 investment (($5.40 – $1.20) x 100 shares)

*The 10-strike price put be worth $3.40 and Trader B will have a profit of $942 on his $78 investment (($3.80 – $0.26) x 100 shares x 3 options)

Summary

Anytime you make a trade, it is essential that you understand what you are getting into. In our example above:

*Buying the out-of-the-money put gives a trader the best opportunity to maximize profitability if things go as hoped.

*Buying the in-the-money put gives a trader the best opportunity to make some money if USO decline some but not by as much as one would hope.

*Keep in mind: There are no “right or wrong” answers.

*You have to decide your priorities and then deal with the consequences.

*After you make your choice, never look back. If USO only goes down a little Trader B can easily lament “oh, I should have been less aggressive”. If USO goes down, Trader A can easily lament “Oh, I should have been more aggressive.”

*This kind of negative baggage can mess with your decision making for many trades to come.

So fight the urge to second guess yourself after the fact . Make your choice and deal with the outcome unemotionally.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.