Nobody really calls them “junk bonds” so much anymore. Most people in refined circles refer to them as “high yield” bonds now. Sounds way more classy. But the fact remains they are bonds issued by companies with questionable finances. Because their creditworthiness is lower than treasuries junk bonds pay a higher rate of interest than treasuries. The theory is that junk bonds are a “higher risk, higher reward” proposition versus more staid intermediate-term treasuries.

There are two things to note about junk bonds:

*They are typically more correlated to the stock market than to the bond market. To put it another way, as an asset class junk bonds tend to have a higher correlation to the S&P 500 Index than to the long-term treasury bond (likely because the fate of an individual junk bond is tied more closely to the likelihood that the issuing company will survive long enough to make all the payments than to interest rate fluctuations).

*Junk bonds have a slightly favorable seasonal tendency during December and January

We will use these two factors to create a trading “System”,such as it is. But first let’s look at two benchmarks.

Junk Bond benchmark: To track junk bond returns we use monthly total return data for Vanguard High-Yield (ticker VWEHX) starting in January 1979

Intermediate-term treasury benchmark: For January through April 1979 we use the Bloomberg Barclays Intermediate-term treasury monthly total return. Starting in May 1979 we use Fidelity Government Income Fund (ticker FGOVX)

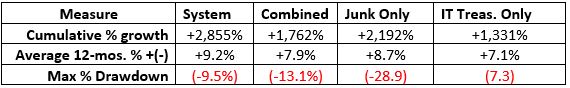

Figure 1 displays the cumulative growth of $1,000 invested in our benchmarks on a buy-and-hold basis.

Figure 1 – Growth of $1,000 buying-and-holding junk bonds (blue) or intermediate-term treasuries (orange)

Junk bonds grew +2,192%, with an average 12-month gain of +8.7% and a maximum drawdown of -28.9%

Intermediate-term treasuries grew +1,331%, with an average 12-month gain of +7.1% and a maximum drawdown of -7.3%

So it would appear that the line about junk bonds being “higher risk, higher reward” appears to be based in fact.

Jay’s “Junky System”

We will hold junk bonds if:

*The S&P 500 Index closed the previous month above it’s 10-month moving average (i.e., if stocks are in an uptrend then hold junk bonds)

*If the current month is December or January

*If neither of the above is true then hold intermediate-term treasuries (i.e., if it is February through November AND the S&P 500 Index closed the previous month below its 10-month moving average)

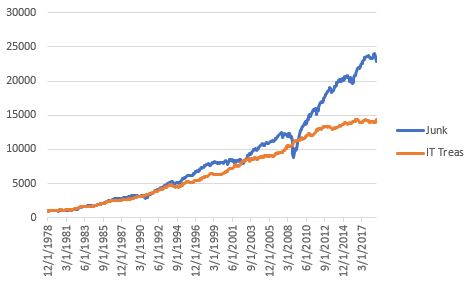

Figure 2 displays the growth of $1,000 using our “System” versus simply buying and holding junk bonds.

Figure 2 – Jay’s Junky System versus buying and holding junk bonds

The System grew +2,855%, with an average 12-month gain of +9.2% and a maximum drawdown of -9.5%.

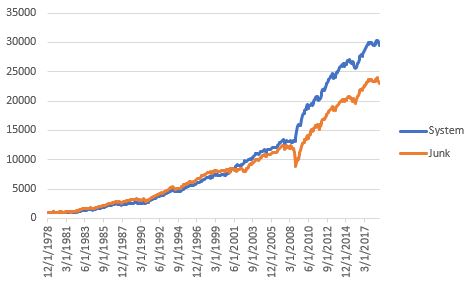

Figure 3 – Comparative Results

Figure 3 – Comparative Results

Summary

So, is the “World-Beater, You Can’t Lose Trading Bonds” approach to trading bonds? Probably not. Is it a potential improvement on buying-and-holding junk bonds and/or intermediate-term treasuries?

That’s for you the reader to decide.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.

Alternatively titled, “When to Hold Your Junk”