In the immortal words of Steve Martin, sometimes it pays to “Get Small.” Still, other times not so much. So, it’s not just getting small that matters but more importantly, when you get small. Or large as the case may be.

OK, I am pretty sure Steve Martin was not talking about small-cap stocks (or small-cap stocks versus large-cap stocks for that matter), but maybe he should have been. Over the years some distinct seasonal trends or patterns have emerged within the endless “large-cap stocks versus small-cap stocks” debate.

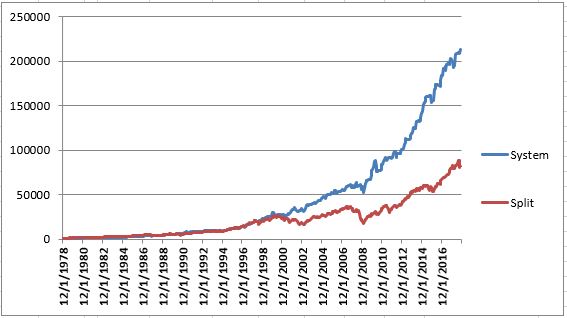

Let’s keep this one succinct. Figure 1 displays our “Seasonal Table” for the calendar year. As you can see each month lists one and only one security – either large-cap stocks, small-cap stocks or intermediate-term treasuries.

Figure 1 – Large-Cap/Small-Cap/Int. Treasuries Calendar

To test this, we will use monthly total return data starting in January 1979 for the Russell 1000 Index (large-cap stocks), the Russell 2000 Index (small-cap stocks) and the Barclays Treasury Intermediate Index (intermediate-term treasuries)

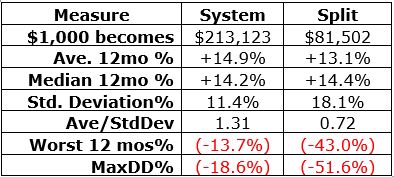

Figure 2 displays the growth of $1,000 invested using this calendar starting 12/31/1978 versus simply splitting the original $1,000 between large-cap and small-cap stocks. Figure 2 – Growth of $1,000 invested using “System” versus “Splitting” between large-cap and small-cap.

Figure 2 – Growth of $1,000 invested using “System” versus “Splitting” between large-cap and small-cap.

Figure 3 – System versus Split facts and figures

Summary

A few key things to note:

*There is nothing “set in stone” about which index performs best during which month and these relationships may change over time

*The “System” showed a gain in 36 of 40 calendar year while “Splitting” showed a gain in 29 out of 40 years

*Year to year can vary greatly. The “System” outperformed “Splitting” in only 23 of 40 calendar years (NOTE: this kind of “hit or miss” year-to-year result often leads investors to abandon a method after a few years of “misses”).

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.

What do you use for “Large Cap” and “Small Cap” that are elf’s?

Paul, please do not consider this a “definitive” answer but I like RSP (S&P 500 Equal Weight) for large-cap (EW has outperformed Cap weighted pretty consistently over time) and IJR for small-cap. Hope that helps. Jay