In this article I detailed an obscure but simple trend-following tool. In this article I detailed an obscure but simple (except for all of the calculations – which I am pretty sure is why God invented software) oversold indicator. So, it only seems logical that the next step would be to combine the two.

The Indicators

To review, there are two indicators:

MACD4010501: Which is basically just a 40-week exponential average minus a 105-week exponential average

VixRSI14: Which combines Larry Williams VixFix indicator with Welles Wilder’s RSI indicator

(Code for these indicators in AIQ Expert Design Studio appears at the end of the article)

The Caveat

What follows is NOT intended to be used to generate specific buy and/or sell signals. The proper way to use it is to tell you when to consider playing the long side and when to consider selling short or simply standing aside.

The Rules

A “potentially bullish” situation exists when:

*Weekly MACD4010501 is trending higher

AND

*Weekly VixRSI14 is trending lower

AND

*Daily MACD4010501 is trending higher

A “potentially bearish” situation exists when:

*Weekly MACD4010501 is trending lower

AND

*Weekly VixRSI14 is trending higher

AND

*Daily MACD4010501 is trending lower

In a nutshell, we look for a bullish setup on the weekly chart (i.e., rising MACD4010501 and declining VixRSI4) and then look for a rising MACD4010501 on the daily chart

Bearish Example

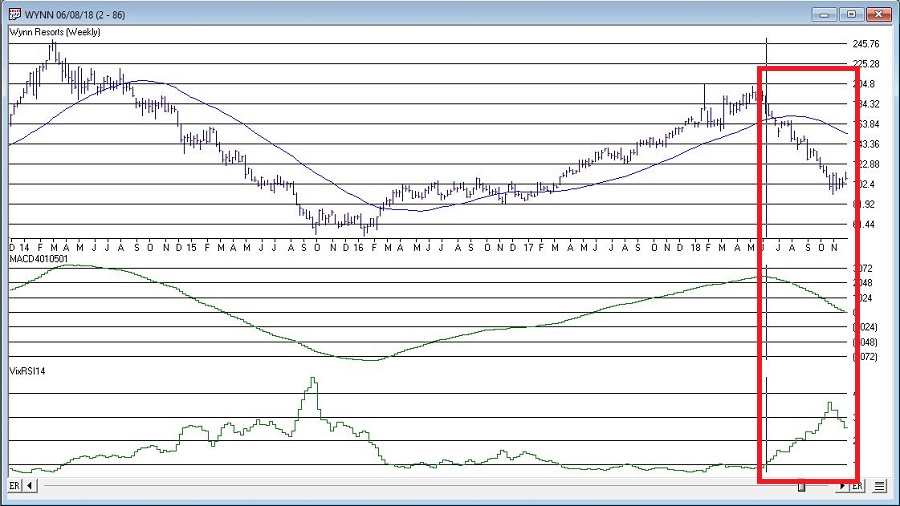

In my previous article I used ticker WYNN, so let’s use the rules above to identify a time to play the long or short side.

In Figure 1, we that on a weekly chart for WYNN MACD40501 turned down on 6/8/18 and VixRSI14 was trending higher. This is a bearish “alert” (NOT an automatic sell signal!).

Figure 1 – Weekly WYNN; Bearish “Alert” in June 2018 (Courtesy AIQ TradingExpert)

Figure 1 – Weekly WYNN; Bearish “Alert” in June 2018 (Courtesy AIQ TradingExpert)

In Figure 2 we go to the daily chart for WYNN. After 6/8/18 the daily MACD4010501 indicator continues to trend lower until late October. This tells us that we should either be playing the short side of WYNN or standing aside.

Figure 2 – Daily WYNN; daily trend indicator bearish after weekly “alert” (Courtesy AIQ TradingExpert)

Figure 2 – Daily WYNN; daily trend indicator bearish after weekly “alert” (Courtesy AIQ TradingExpert)

One important thing to note:

*I am not suggesting that a trader should have sold short WYNN on 6/8/18 and held that short position until late October. What I am suggesting is that active traders should be focusing on trying to make money from bearish positions (short stock, long puts, etc.) during this time

Bullish Example

In Figure 3, we that on a weekly chart for WYNN MACD40501 was trending higher and VixRSI14 ticked lower on 1/6/17. This is a bullish “alert” (NOT an automatic buy signal!).

Figure 3 – Weekly WYNN; Bullish “Alert” (Courtesy AIQ TradingExpert)

Figure 3 – Weekly WYNN; Bullish “Alert” (Courtesy AIQ TradingExpert)

In Figure 4 we go to the daily chart for WYNN. After 1/6/17 the daily MACD4010501 indicator continues to trend higher until the end of June. This tells us that we should either be playing the long side of WYNN or standing aside.

Figure 4 – Daily WYNN; daily trend indicator bullish after weekly “alert” (Courtesy AIQ TradingExpert)

Figure 4 – Daily WYNN; daily trend indicator bullish after weekly “alert” (Courtesy AIQ TradingExpert)

Summary

Once again, please note that I am not advocating using the “rules” above as automated buy and sell signals. Their purpose is simply to help a trader get in line with the dominant trend in price.

Typically, good trading is a function of putting the right pieces in place. A trend identification method such as the above may serve as one piece. Specific entry and exit criteria as well as good capital allocation and risk management methods must also be part of the equation.

Indicator Code

Below is the code for MACD4010501, VixFix, RSI14 and VixRSI14 from AIQ Expert Design Studio.

!#######################################

!MACD4010501 code

Define ss3 40.

Define L3 105.

ShortMACDMA3 is expavg([Close],ss3)*100.

LongMACDMA3 is expavg([Close],L3)*100.

MACD4010501 is ShortMACDMA3-LongMACDMA3.

!#######################################

!#######################################

!VixFix indicator code

hivalclose is hival([close],22).

vixfix is (((hivalclose-[low])/hivalclose)*100)+50.

!#######################################

!#######################################

!RSI14 code

Define days14 27.

U14 is [close]-val([close],1).

D14 is val([close],1)-[close].

AvgU14 is ExpAvg(iff(U14>0,U14,0),days14).

AvgD14 is ExpAvg(iff(D14>=0,D14,0),days14).

RSI14 is 100-(100/(1+(AvgU14/AvgD14))).

!#######################################

!#######################################

!VixRSI14 code

VixRSI14 is expavg(vixfix,3)/expavg(RSI14,3).

!#######################################

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.