Well that didn’t go well. The month of October that is. With most of the major stock market averages drooping below significant long-term moving averages and with some of the moving averages starting to “roll over” – not to mention rising interest rates, a key election and the rest of the world’s stock markets plunging – there is suddenly a lot of “doubt” out there.

And if price action does not improve soon my view is that investors do need to consider playing some “defense” (i.e., reduce risk, even if it ultimately means buying back in higher). But the good news is that there is a chance that things will improve in the not too distant future.

The (Seasonal) Trend

For one thing, there are a lot of signs of an “oversold” market (see here for one example). Another “thing” hiding in plain sight from most investors is that we are about to hit one of the “sweet spots” in the 4-year election cycle. To wit:

*We will call the month of November in the mid-term election year through the month of April in the pre-election year a “bullish seasonal period.”

The Results

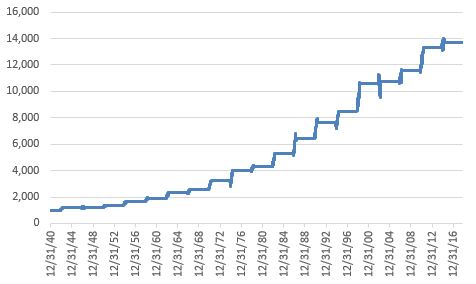

Figure 1 displays the growth of $1,000 invested in the Dow Jones Industrials Average ONLY during November of each mid-term election year through the end of April of the pre-election year (i.e., 6 months) starting on 12/31/1940.

Figure 1 – Growth of $1,000 invested in Dow Jones Industrials Average; November 1 of Mid-Term Year through April 30 of Pre-Election Year; 12/31/1940-10/26/2018

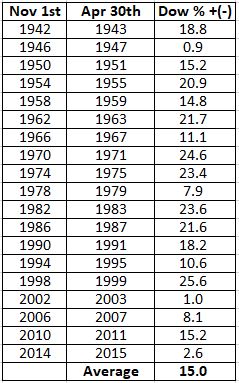

Figure 2 displays the returns seen by the Dow during the period in each election cycle.

Figure 2 –Dow Jones Industrials Average % price return; November 1 of Mid-Term Year through April 30 of Pre-Election Year; 12/31/1940-10/26/2018

*As you can see, the average 6-month return during this period is a resounding +15.0%.

*The largest gain was +25.6% during 1998-1999.

*The worst performance was a gain of +0.9% in 1946-1947.

Summary

So, does this mean that the worst is behind us and that stocks are destined to zoom higher in the months ahead? Not necessarily. As always, the one problem with seasonal trends is that you never know for sure if they are going to pan out as expected “this time around”.

Still, the consistency displayed in Figures 1 and 2 – combined with the heightened bearish sentiment currently surrounding the market – suggests that now may not be the exact moment to hit the panic button.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.