Suddenly everyone is once again singing the praises of long-term treasuries. And on the face of it, why not? With interest rates seemingly headed to negative whatever, a pure play on interest rates (with “no credit risk” – which I still find ironic since t-bonds are issued by essentially the most heavily indebted entity in history – the U.S. government) stands to perform pretty darn well.

But is it really the best play?

Long-Term Treasuries vs. “Others”

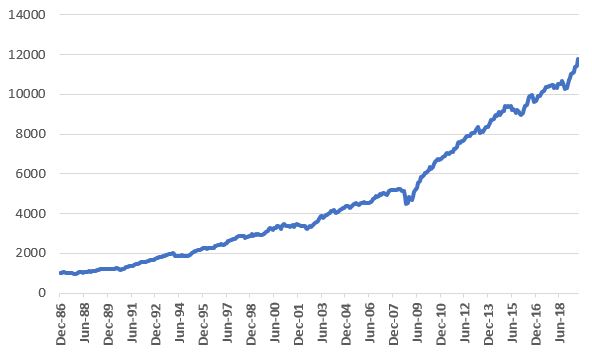

Because a later test will use the Bloomberg Barclays Convertible Bond Index, and because that index starts in 1986 and because I want to compare “apples” to “apples”, Figure 1 displays the growth of $1,000 since 1986 using monthly total return data for the Bloomberg Barclays Treasury Long Index.

Figure 1 – Growth of $1,000 in Long-Term Treasuries (1987-2019)

For the record:

| Ave. 12 mo % | +8.2% |

| Std. Deviation | +9.0% |

| Max Drawdown | (-15.9%) |

| $1,000 becomes | $12,583 |

Figure 2 – Bloomberg Barclays Treasury Long Index (Jan 1987-Jul 2019)

Not bad, apparently – if your focus is return and you don’t mind some volatility and you have no fear of interest rates ever rising again.

A Broader Approach

Now let’s consider an approach that puts 25% into the four bond indexes below and rebalances every Jan. 1:

*Bloomberg Barclay’s Convertible Bond Index

*Bloomberg Barclays High Yield Very Liquid Index

*Bloomberg Barclays Treasury Long Index

*Bloomberg Barclay’s Intermediate Index

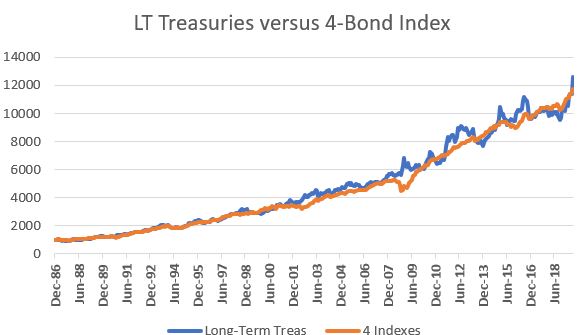

Figure 3 displays the growth of this “index” versus buying and holding long-term treasuries.

Figure 3 – Growth of $1,000 invested in 4-Bond Indexes and rebalanced annually; 1987-2019

| Ave. 12 mo % | +8.0% |

| Std. Deviation | +6.8% |

| Max Drawdown | (-14.8%) |

| $1,000 becomes | $11,774 |

Figure 4 – 4-Bond Index Results; 1987-2019

As you can see, the 4-index approach:

*Is less volatile in nature (6.8% standard deviation versus 9.0% for long bonds)

*Had a slightly lower maximum drawdown

*And has generated almost as much gain as long-term treasuries alone (it actually had a slight lead over long-term treasuries prior to the rare +10% spurt in long treasuries in August 2019)

To get a better sense of the comparison, Figure 5 overlays Figures 1 and 3.

Figure 5 – Long Treasuries vs. 4-Bond Index

As you can see in Figure 5, in light of a long-term bull market for bonds, at times long-term treasuries have led and at other times they have trailed our 4-Bond Index. After the huge August 2019 spike for long-term treasuries, they are back in the lead. But for now, the point is that the 4-Bond Index performs roughly as well with a great deal less volatility.

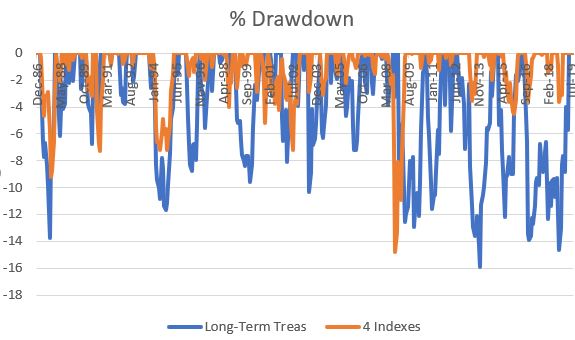

To emphasize this (in a possibly slightly confusing kind of way), Figure 6 shows the drawdowns for long treasuries in blue and drawdowns for the 4-Bond Index in orange. While the orange line did have one severe “spike” down (during the financial panic of 2008), clearly when trouble hits the bond market, long-term treasuries tend to decline more than the 4-Bond Index.

Figure 6 – % Drawdowns for Long-term treasuries (blue) versus 4-Bond Index (orange); 1987-2019

Summary

Long-term treasuries are the “purest interest rate play” available. If rates fall then long-term treasuries will typically outperform most other types of bonds. On the flip side, if interest rates rise long-term treasuries will typically underperform most other types of bonds.

Is this 4-index approach the “be all, end all” of bond investing? Is it even superior to the simpler approach of just holding long-term bonds?

Not necessarily. But there appears to be a better way to use these four indexes – which I will get to in Part II. So stay tuned.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.