The “September Strategy” (such as it is) can be summed up pretty simply as follows:

“Enjoy the holiday. Then take the rest of the month off”.

Here are the “rules” (such as they are):

Step 1) Hold the S&P 500 Index January through August and October through December

Step 2) Also hold the SPX for the first three trading days during September. During all other trading days in September, hold cash (for testing purposes we assume an annualized rate of interest of 1% per year while out of stocks).

To put it another way:

Step 1) Sell the S&P 500 Index at the close of the 3rd trading day of September

Step 2) Buy back the S&P 500 Index at the close of the last trading day of September

OK, so as far as “strategies” go there isn’t much to it granted. Still, before dismissing it as overly simplistic, let’s take closer look.

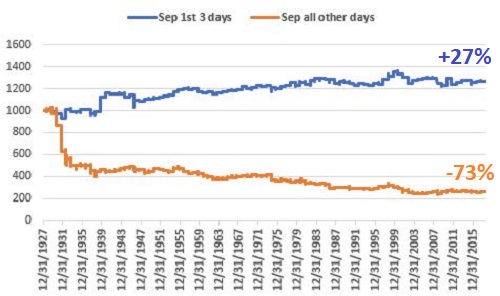

Figure 1 displays:

*The growth of $1,000 invested in the S&P 500 index ONLY during the 1st 3 trading days of September from 12/31/1927 through 8/27/2018 (blue line).

*The growth of $1,000 invested in the S&P 500 index ONLY during ALL OTHER trading days of September during the same time (orange line).

Figure 1 – Growth of $1,000 invested in the S&P 500 Index ONLY during the 1st 3 trading days of September (blue) versus all other trading days of September (orange); 12/31/1927-8/27/2018

Bottom line:

*1st 3 trading days of September: Sort of OK

*All other September trading days: Not so good

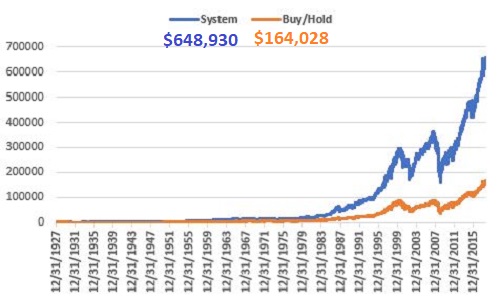

Figure 2 displays the cumulative growth of $1,000 invested using the “System” rules spelled out above versus buy-and-hold since 12/31/1927.

Figure 2 – Growth of $1,000 using the “September Strategy” (blue) versus buying-and-holding the Dow (orange); 12/31/1927-8/27/2018

For the record, from 12/31/1927 through 8/27/2018:

*$1,000 invested using the “System” grew to $658,930

*$1,000 invested using buy-and-hold grew to $164,028

i.e., over roughly 90 years the “System” has outperformed buy-and-hold by roughly 4-to-1.

So clearly, over the course of the last roughly 90 years stock market performance during September has been, um, “inferior.”

Summary

So, is September like a bad penny – something that should be avoided? Or does “history” even matter any more, when the stock market basically just opens higher every day and then accelerates higher from there?

It beats me. I just report the numbers and let you decide.

In any event, hey, enjoy the holiday!

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.

I love all these combinations and permutations you come up with, Jay, but I often end up confused (like now) when I remember other reports that say to trade or not to trade on the Best Trading Days of the Month (*TDM 5 and 6, *TDM 13, 14, 15 and 16, *TDM -7, -6, -5). I mean what’s a trader to do?!

Excellent question! A couple o’ thoughts. First off please remember that this blog is less about telling people how to trade and more about just spewing the random ideas that pass through one market-addled mind. I also write at times to what I perceive to be different audiences (long-term investors, short-term traders, option traders, commodity traders, etc).

So it is not uncommon for one idea to conflict with another. Like – as you pointed out – the trading day of the month approach versus the September Strategy (which is always in the market except for most of September). Here is the reality: History suggests that “traders” who are out of the market on all the “Bad Days” of the month make a lot more money than people who are always in. At the same time, the reality is that very few people are actually going to trade in and out a couple times of month every month of every year regardless of how the “system” is performing. On the other hand some people might consider getting out during the bulk of September. A different idea for a different audience.

I don’t know if that helps, but there you have it. Take Care, Jay

Thanks for your response. Please understand that I’m not expecting you to come up with the ideal strategy for, in my case, trading. I am quite willing frequently to move in and out of the markets when it’s advantageous. And I think most readers know by what you’re providing which is for traders, which for longer term investors. Specifically, re the September Strategy, I’d love to see such a breakdown for each month! Imagine finding it advantageous to be in the market only a few days per month! (Hey, one can dream…) Thanks again!