In this article we are NOT going to talk about trading or investing “specifics”. We are going to talk about “Peace of Mind.”

When you stop and think about it, it’s almost a little mind-boggling to consider the collective amount of angst and anguish that investors suffer, even – or perhaps I should say “especially” – during a bull market.

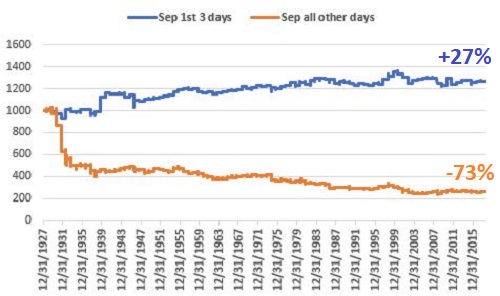

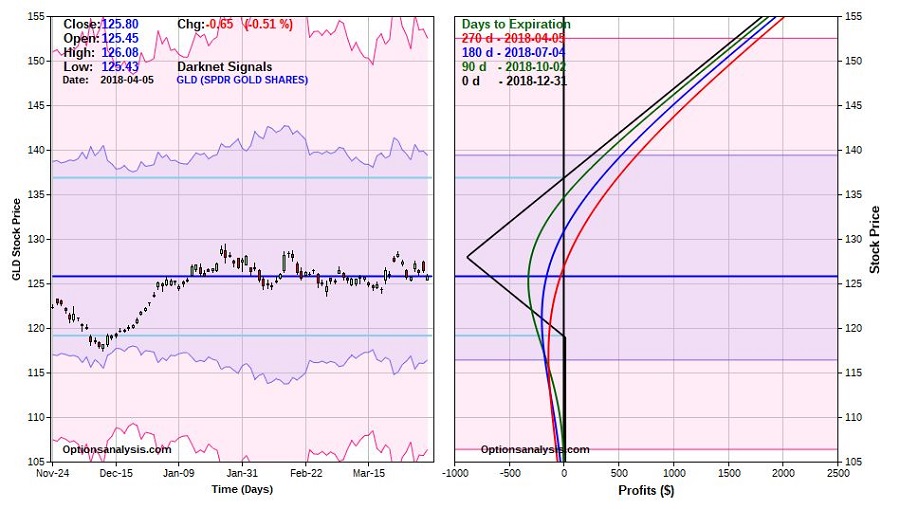

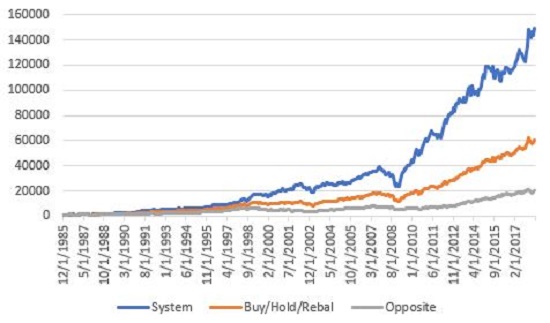

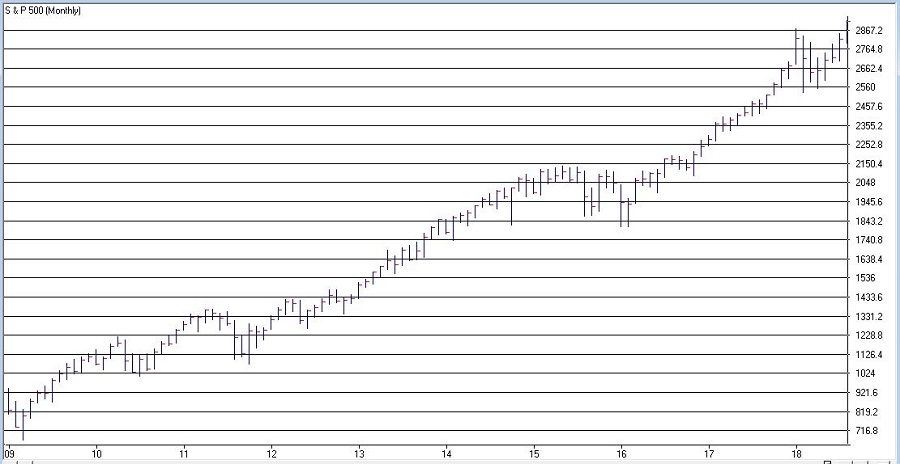

Take a quick glimpse at Figure 1 (click to enlarge) Figure 1 – The S&P 500 Index (Courtesy AIQ TradingExpert)

Figure 1 – The S&P 500 Index (Courtesy AIQ TradingExpert)

Then consider how may times between the starting point at the lower left and the ending point at the upper right, you have read an article urging at least “caution” if not downright “concern”. Or how many times you have heard a pundit discuss in somber tones the “inevitable” negative impact of [rising rates/a narrowing yield curve/overvaluation/China this, China that/(one of 10,000 other possible concerns here)]?

Now the irony is that of course ultimately, these warnings will prove to be right – at least to some extent. At some point this bull market will end (no, seriously) and history suggests that, yes, in fact the next bear market will not be of the 15-20% orderly correction variety, but rather “one of the painful kind”. See, even I sound like those guys I just mentioned.

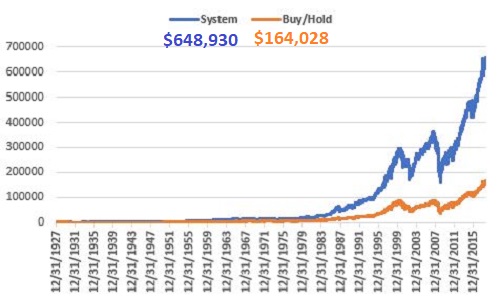

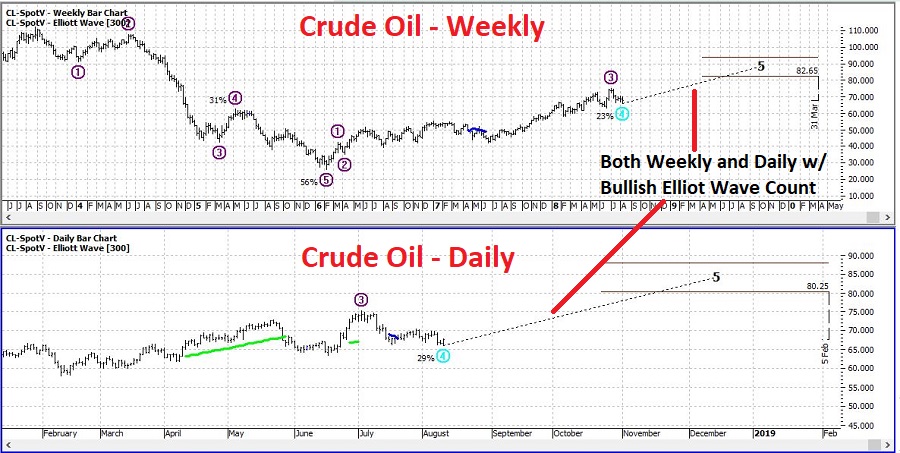

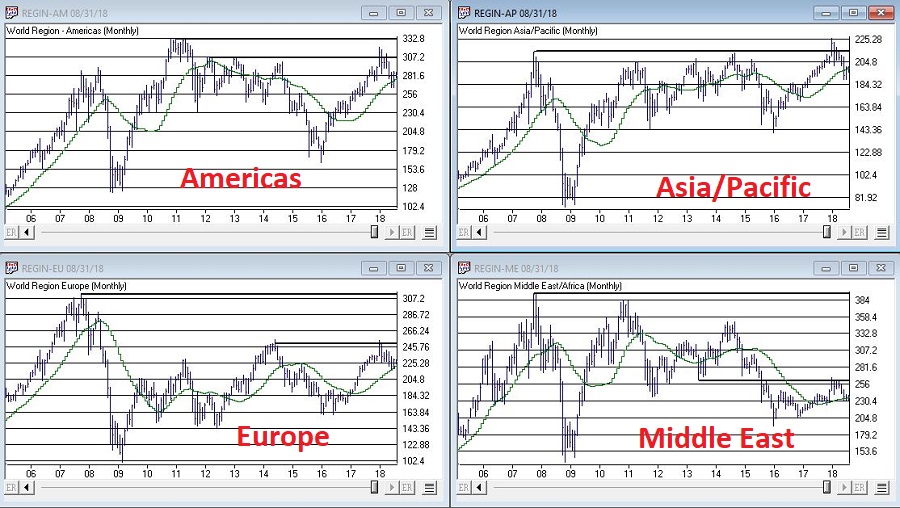

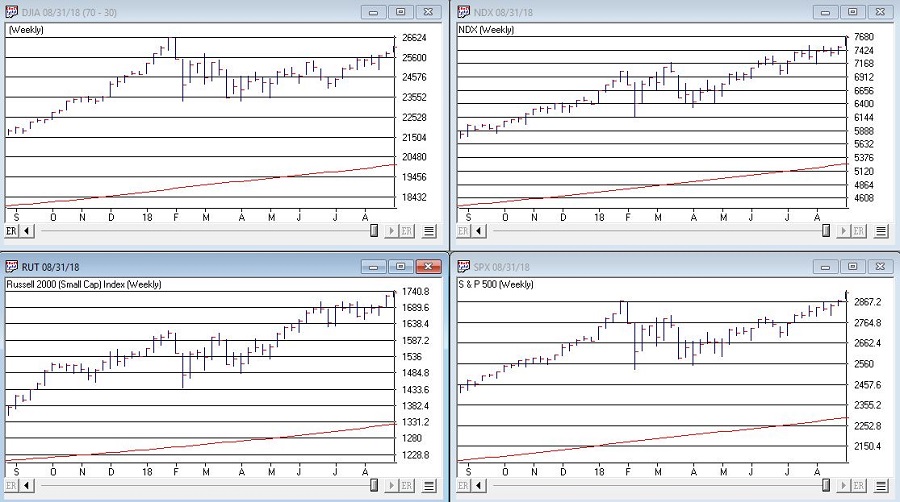

But that’s OK, because caution is always in order when it comes to investing your money. Angst and anguish and fear on the other hand are wasted emotions. Figure 2 shows 4 major market averages. 3 have broken out to new highs – only the Dow Industrials have not. All 4 are well above their 200-day moving averages, i.e., in established uptrends.

(click to enlarge) Figure 2 – Four major market averages (Courtesy AIQ TradingExpert)

Figure 2 – Four major market averages (Courtesy AIQ TradingExpert)

Trouble in the market may always be just a few days away. But when it comes to dealing with investing in terms of “The Big Picture”, here is my advice:

*When all the major averages are above their 200-day moving averages (not that there is anything magic about 200-days) try to enjoy your life. Don’t worry, be happy (this does NOT mean “stick your head in the sand and pay no attention to the markets. It means flush the angst and simply focus on following your investment strategy – proper allocation, letting your profits run, cutting your losses, etc., etc.).

*At the same time, remain alert and DO NOT fall in love with a bull market and especially DO NOT “star gaze”, i.e., become enamored with speculating about how much money you are going to make. In this regard, remember the two following thoughts.

Jay’s Trading Maxim #44: If you are walking down the street and you trip and fall that’s one thing. If you are climbing a mountain and you trip and fall that is something else. And if you are gazing at the stars and don’t even realize that you are climbing a mountain and trip and fall – the only applicable phrase is “Look Out Below”.

From Warren Buffet: “Bull markets are like sex. They feel best at the end.”

*Remember that someday YES, the major averages WILL fall back below their long-term moving averages and some serious defensive action on your part WILL BE necessary if you want to avoid the ravages of riding a multi-year bear market all the way down to the ocean floor.

Now wasn’t that simple?

Summary

As you read and listen to all the “warnings” remember this simple guide to investing contentment. In sum:

*If the market is going up and the averages are in uptrends – smile, life is good. Relax and enjoy and ignore/avoid the angst.

*If the market is going down and the average are in downtrends – defend yourself aggressively (or at least your investment capital)!!

In any event, have a nice day…

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.